Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Council adopts TAP sidewalk ordinance; MoDOT’s I‑44 bridge package may include Selma Avenue pedestrian bridge

Webster Groves holds public hearing on 2025 property tax rates; reassessment raised valuations pending board review

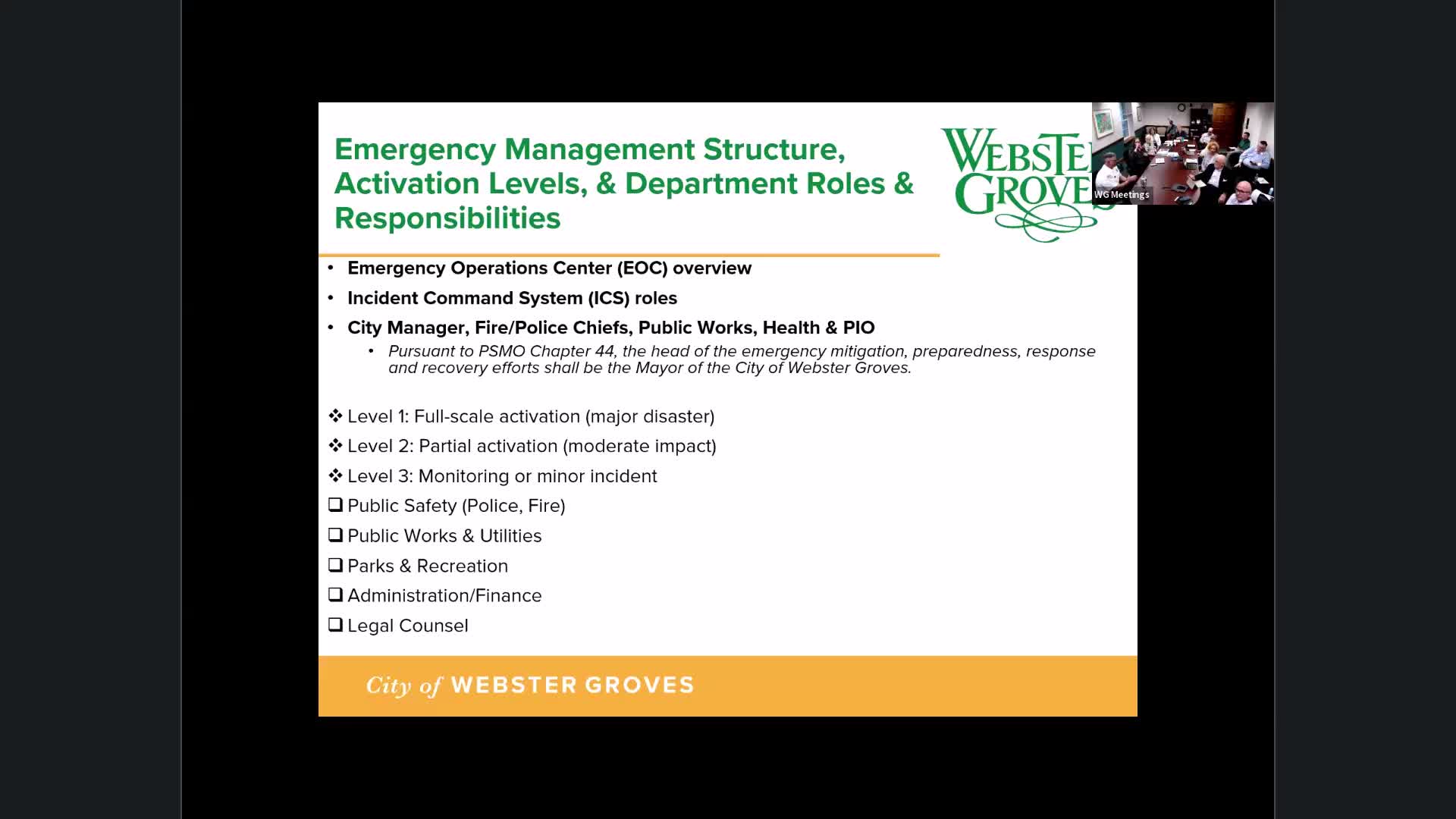

Webster Groves chiefs present 166-page draft emergency operations plan; legal review and training next

City says Douglass Manor likely to close Sept. 13; HUD, owner communications unclear