Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Board discusses objection to newly purchased library title; administration says book will be reviewed and removed pending policy review

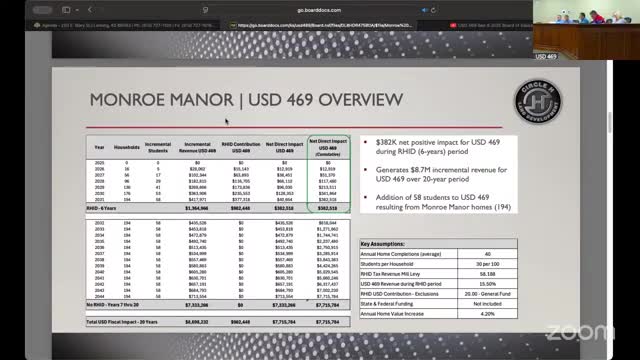

Developer pitches Monroe Manor RHID as short-term growth generator for Lansing; board and public ask questions

Board approves up to $100,000 from carryover for Lansing Elementary inclusive playground

Board advances policy allowing posthumous diplomas after parents asked for honorary recognition