Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Staff and actuary discuss using surplus to fund an immunized cash‑flow tranche to reduce volatility if plan reaches full funding

Goldman economist warns tariffs, immigration shifts will slow GDP; flags higher near‑term recession risk

Executive director outlines fund size, trends and strategic‑planning kickoff; Aon to conduct trustee interviews

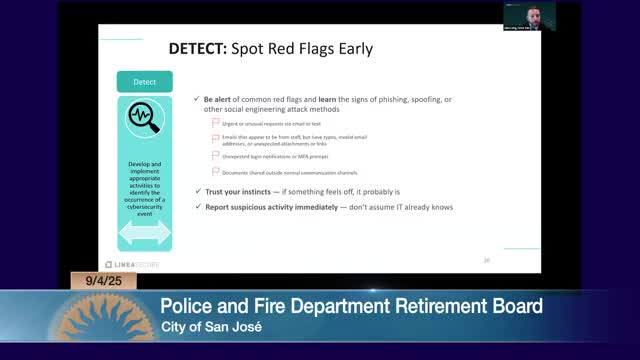

Board hears cybersecurity briefing emphasizing member‑service risks and trustee responsibilities

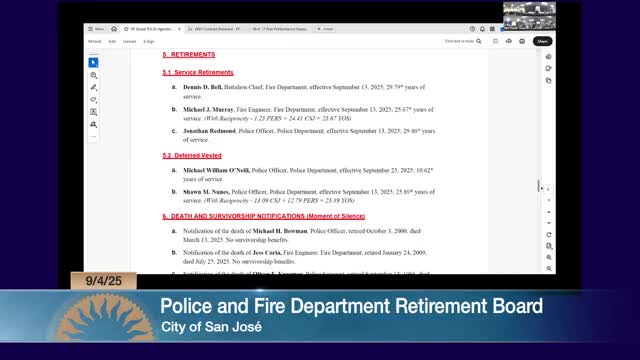

Board approves retirements, records deaths and deferred vested notices