Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

County sets aside $2 million of settlement funds for Superfund site cleanup or site‑prep tied to economic development

Committee approves $4 million emergency appropriation to cover 2025 liability claims and settlements

Single audit finds no federal award findings for Lake County; federal expenditures cited at $77.3 million

County posts maximum tax‑levy estimate using PTELL cap; staff building budget with lower assumption

County board raises video‑gaming pass‑through to cover 2‑1‑1 software costs

Board approves extra mowing, perimeter cuts at Libertyville campus; design work underway

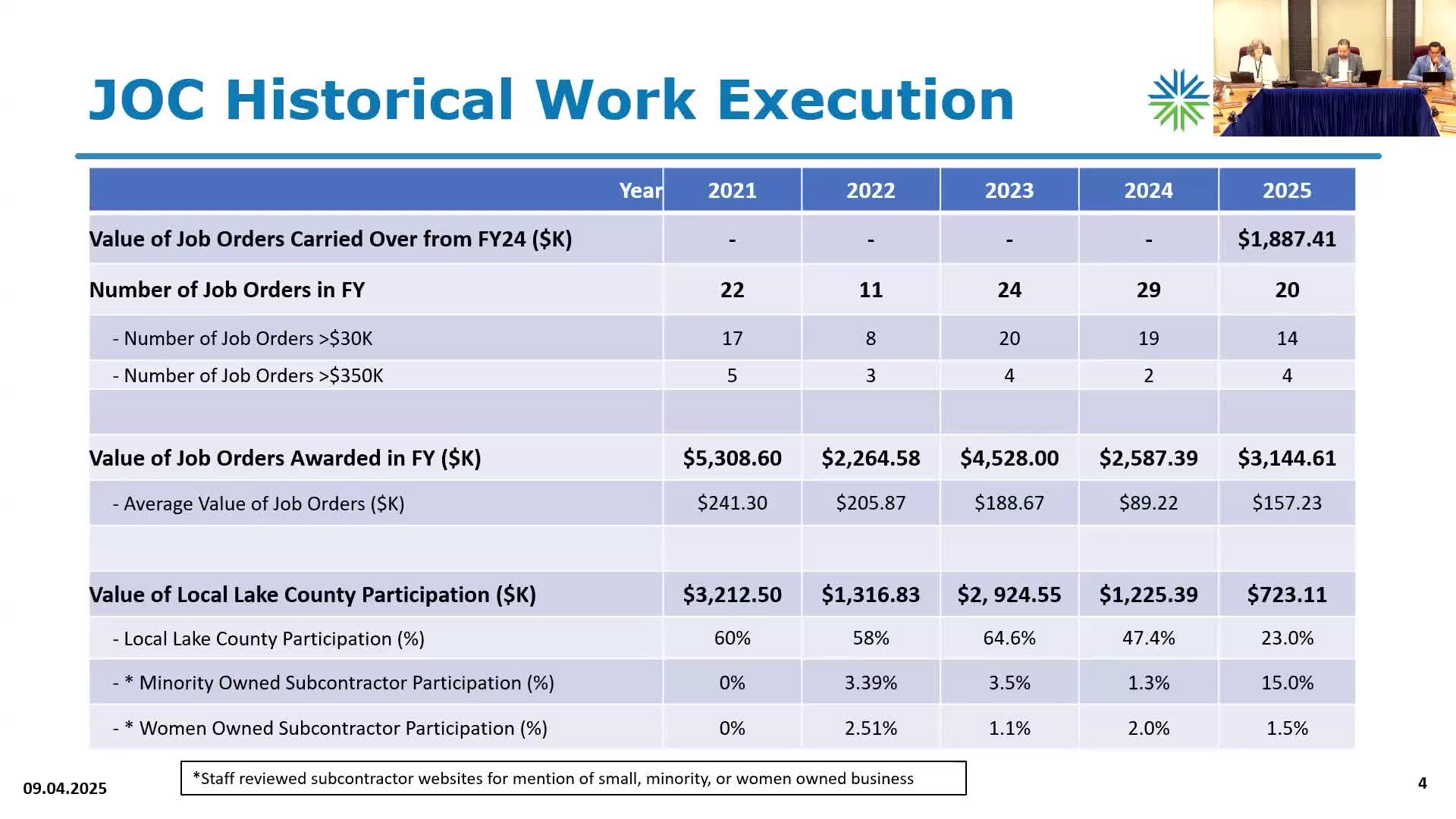

County reports job‑order contract activity and subcontractor diversity metrics