Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

DDA seeks wayfinding overhaul as parking shifts toward pay-by-plate; downtown projects funded largely by TIF and grants

Ferndale advances lead-service-line replacements and proposes steady water-sewer rate increases

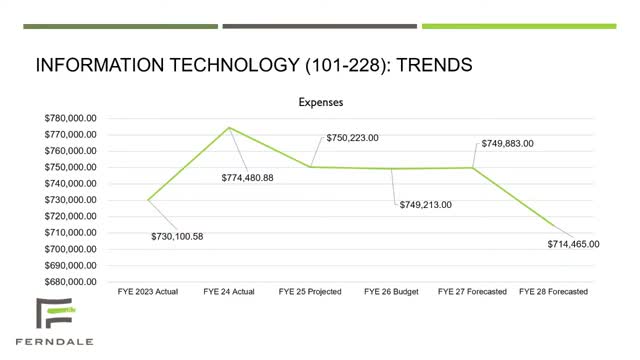

IT security, public-safety vehicles, parks projects dominate Ferndale departments’ capital asks

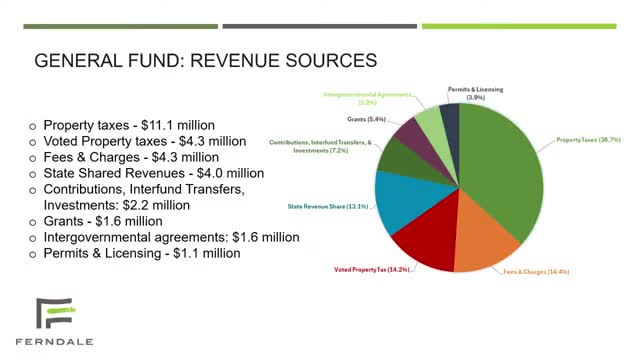

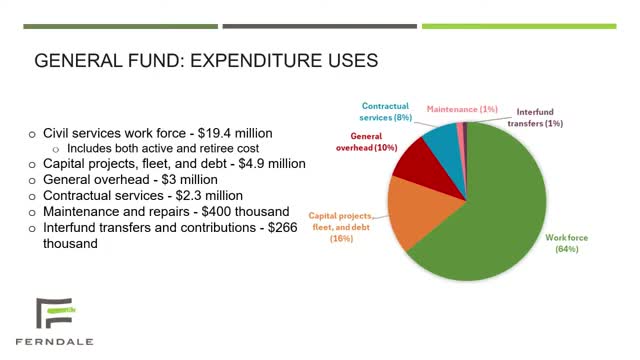

Officials warn Ferndale budget faces growing wage, benefits and contract pressures despite retiree-health savings