Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Alice ISD hires Samira Massey as Newton Elementary principal; retirements and resignations reported

Alice ISD board renews District of Innovation plan; staff outline certification support for teachers

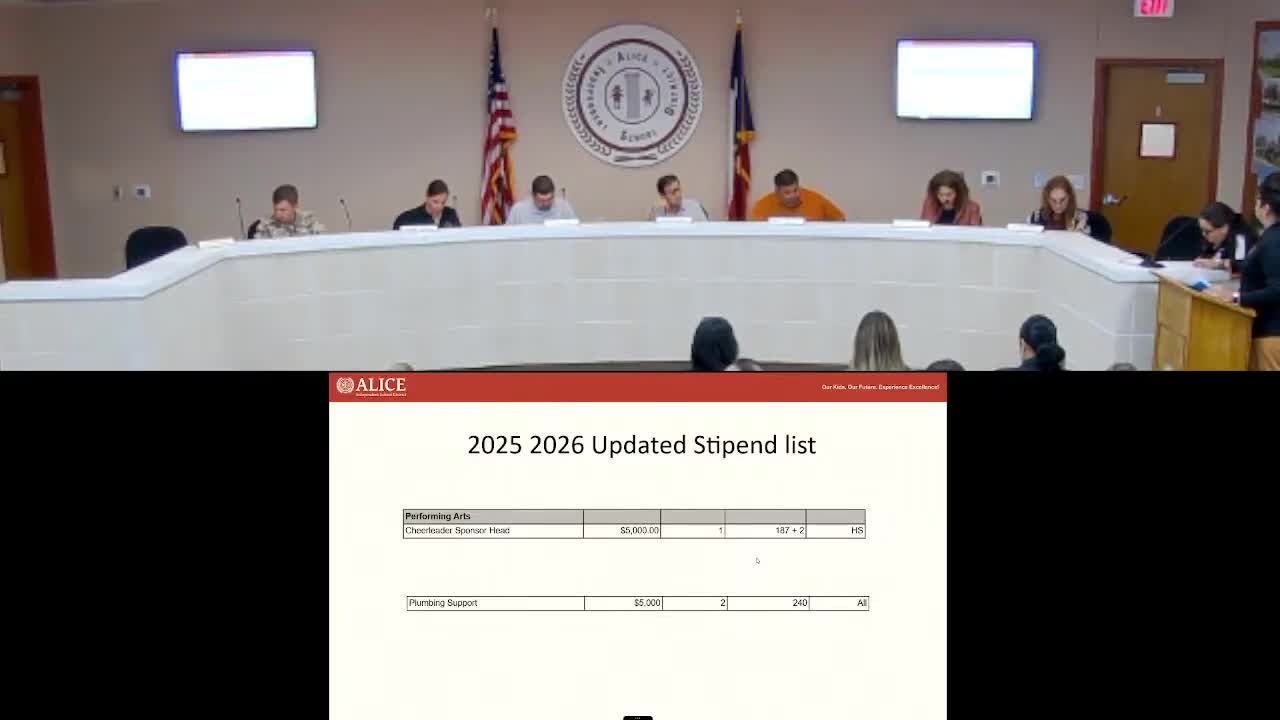

Alice ISD board approves revised 2025–26 stipend list, adds plumbing support stipends