Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Lawyers’ group presents data analysis saying litigation not primary driver of premiums; insurers booked record profits in 2023–24

Consumers and public adjusters tell Georgia committee of denied claims, appraisal and statute-of-limitations hurdles after storms

Foster-care provider warns insurance costs threaten Georgia child-placement services

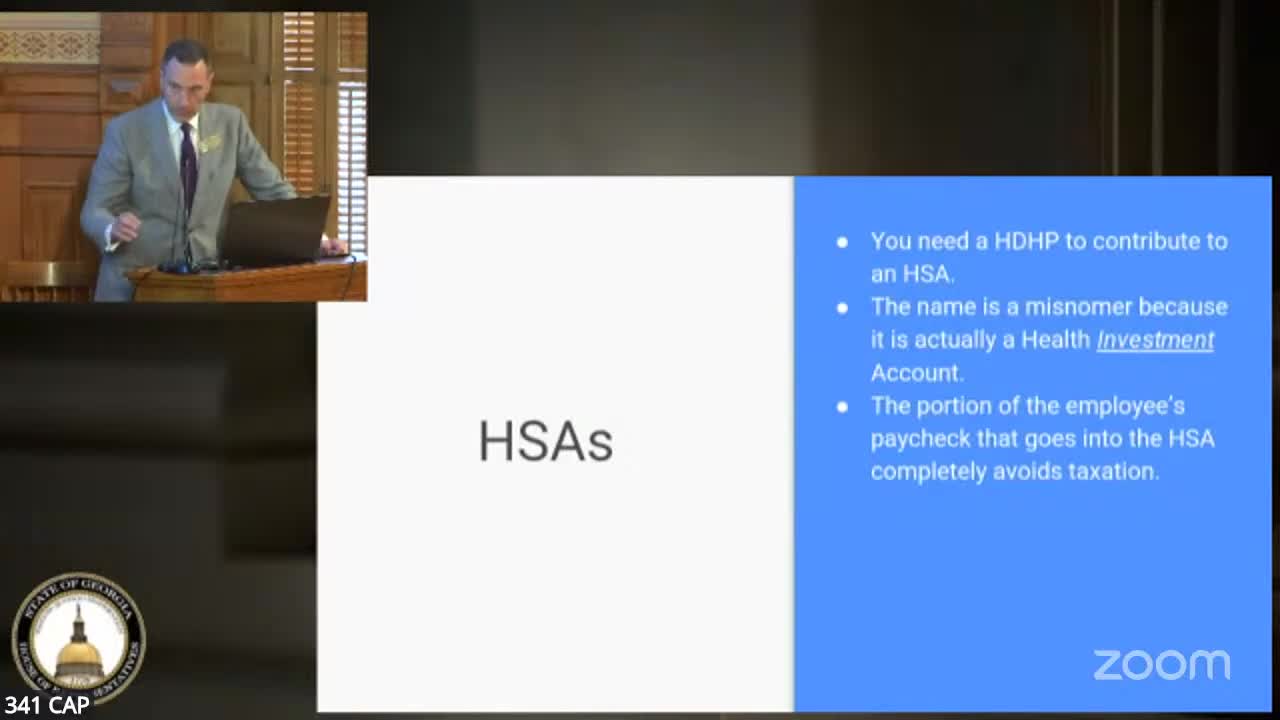

New law will let Georgia state employees make pretax payroll contributions to health savings accounts, officials say