Kansas Control Board Reviews Cannabis Tax Allocation and Establishment Fees

May 16, 2025 | Economic Development, Housing & General Affairs, SENATE, Committees, Legislative , Vermont

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

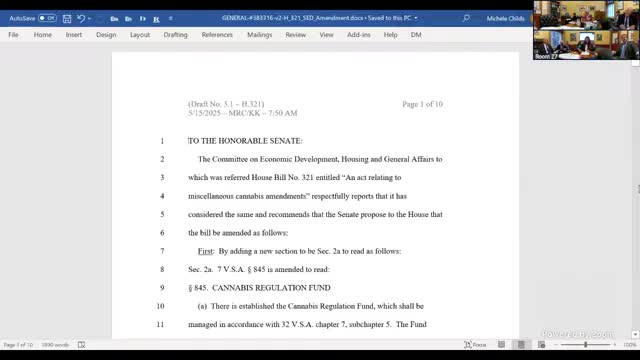

Vermont's Senate Economic Development Committee made significant strides in cannabis regulation during their recent meeting, focusing on the allocation of excise tax revenues and establishment fees. A key decision was made regarding the cannabis regulation fund, with discussions centered on whether the excise tax should be directed to the general fund or remain within the regulation fund. The committee is considering a recommendation from the Joint Fiscal Office (JFO) to transfer the balance of the cannabis regulation fund to the general fund at the end of each fiscal year.

The committee acknowledged the complexities involved in the budget discussions, particularly the ongoing debate about the best use of excise tax revenues. This decision is crucial as it impacts funding for regulatory agencies and the overall financial health of the cannabis program.

Additionally, the committee addressed amendments to cannabis establishment fees, particularly for indoor tier 2 cultivators. After reviewing feedback from stakeholders, the committee opted to revert to existing fee structures for these cultivators, which is expected to mitigate potential financial losses. However, this decision comes with a projected deficit of approximately $68,000, highlighting the ongoing challenges in balancing revenue generation with regulatory needs.

As the committee moves forward, they will continue to collaborate with the finance department to refine these proposals and ensure that the cannabis program remains financially viable while meeting the needs of the community. The implications of these decisions will be closely monitored as Vermont navigates its evolving cannabis landscape.

The committee acknowledged the complexities involved in the budget discussions, particularly the ongoing debate about the best use of excise tax revenues. This decision is crucial as it impacts funding for regulatory agencies and the overall financial health of the cannabis program.

Additionally, the committee addressed amendments to cannabis establishment fees, particularly for indoor tier 2 cultivators. After reviewing feedback from stakeholders, the committee opted to revert to existing fee structures for these cultivators, which is expected to mitigate potential financial losses. However, this decision comes with a projected deficit of approximately $68,000, highlighting the ongoing challenges in balancing revenue generation with regulatory needs.

As the committee moves forward, they will continue to collaborate with the finance department to refine these proposals and ensure that the cannabis program remains financially viable while meeting the needs of the community. The implications of these decisions will be closely monitored as Vermont navigates its evolving cannabis landscape.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting