Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

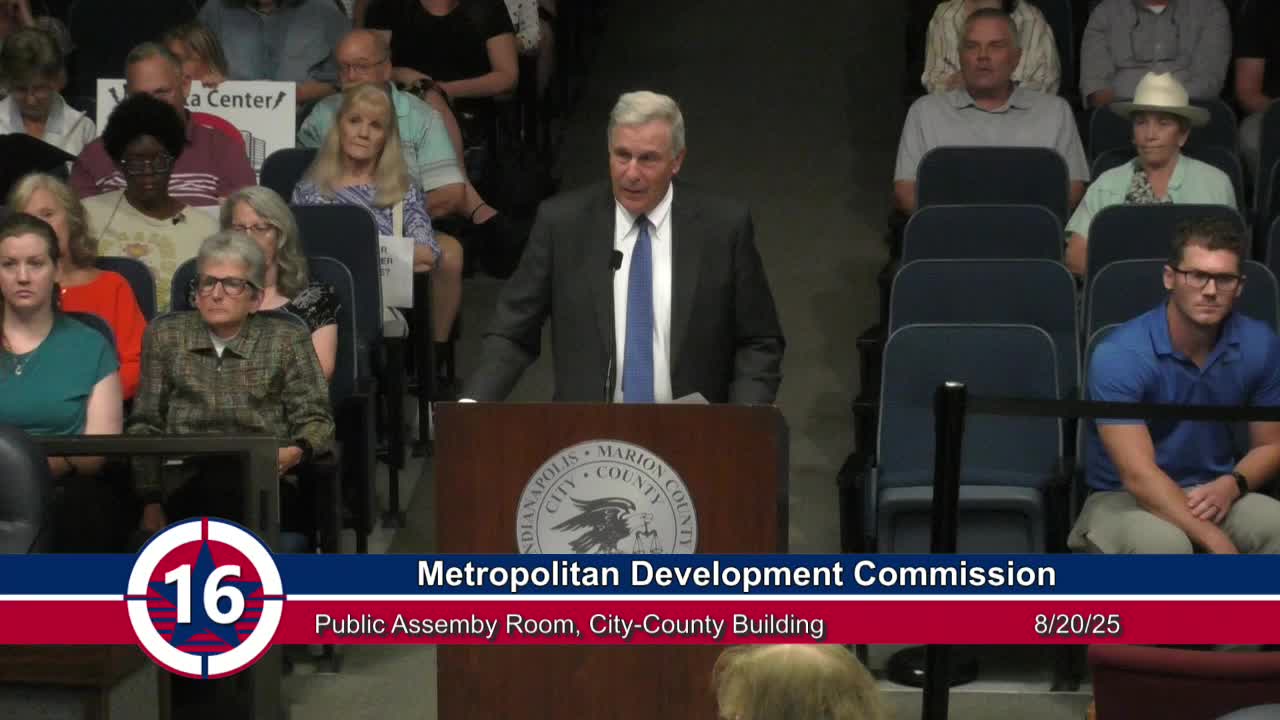

MDC approves economic revitalization resolutions for Roche, several policy resolutions pass unanimously

MDC approves rezoning for Life Village supportive‑housing project but denies variance request