Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Committee advances multiple agreements, property transactions and IT contract renewal; all items pass unanimously

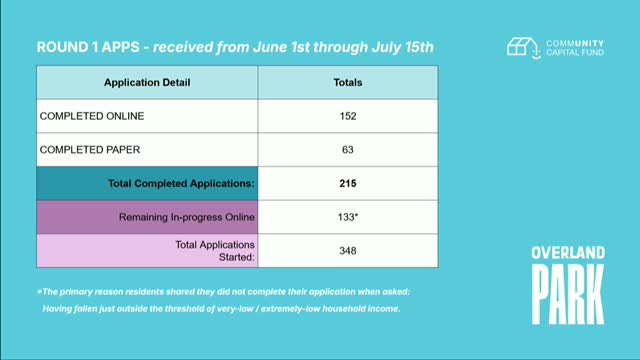

Committee authorizes amendment talks to expand Overland Park property-tax rebate pilot after positive pilot results