Georgia Insurers Discuss Impact of Federal Reinsurance on Local Crop Insurance Rates

August 19, 2025 | Insurance, HOUSE OF REPRESENTATIVES, Committees, Legislative, Georgia

Thanks to Scribe from Workplace AI , all articles about Georgia are free for you to enjoy throughout 2025!

This article was created by AI using a video recording of the meeting. It summarizes the key points discussed, but for full details and context, please refer to the video of the full meeting. Link to Full Meeting

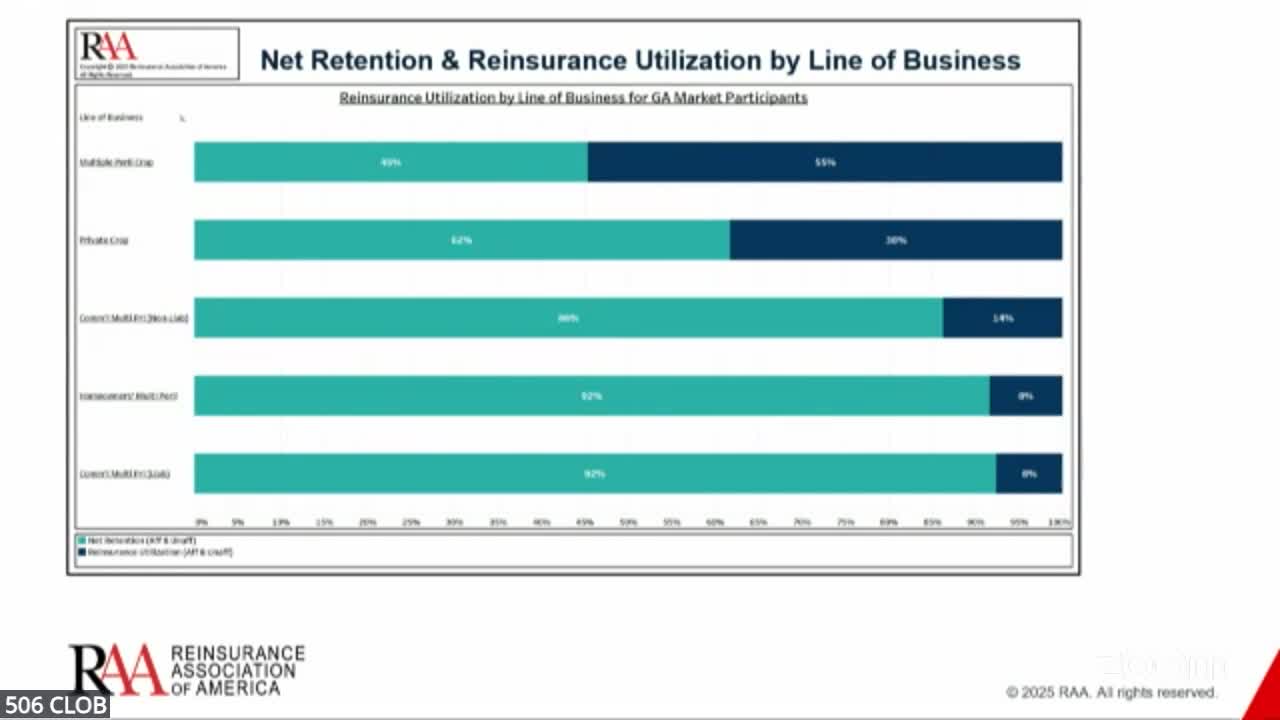

The meeting emphasized that the federal crop insurance program dominates the market, with private crop insurance being described as "tiny." This reliance on federal reinsurance raises questions about the stability and sustainability of Georgia's agricultural sector, particularly in light of recent natural disasters affecting other states, such as California's wildfires and hurricanes in Florida.

Participants discussed the implications of these disasters on insurance rates across the nation. While some questioned whether losses in one state could lead to increased premiums in Georgia, experts clarified that reinsurance operates on a national scale. The pricing is based on a comprehensive assessment of risk across all states, rather than localized losses. However, it was acknowledged that states like Florida, with a high concentration of lightly capitalized insurers, could see direct impacts on their reinsurance costs due to catastrophic events.

The meeting also touched on the broader implications for the insurance marketplace in Georgia. Representatives noted that insurance rates are regulated on a state-by-state basis, and decisions by carriers to withdraw from markets due to high losses can affect availability and pricing for consumers. The importance of maintaining a competitive marketplace was highlighted as essential for ensuring fair rates for Georgia residents.

As the state continues to rely heavily on federal reinsurance for its essential industries, stakeholders are urged to consider the long-term implications of this dependency and the need for a robust insurance framework that can withstand the pressures of natural disasters and market fluctuations. The discussions from this meeting will likely shape future policies aimed at enhancing the resilience of Georgia's agricultural and commercial sectors.

Converted from Reinsurance for Essential Industries 08.19.25 meeting on August 19, 2025

Link to Full Meeting

Comments

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting