Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

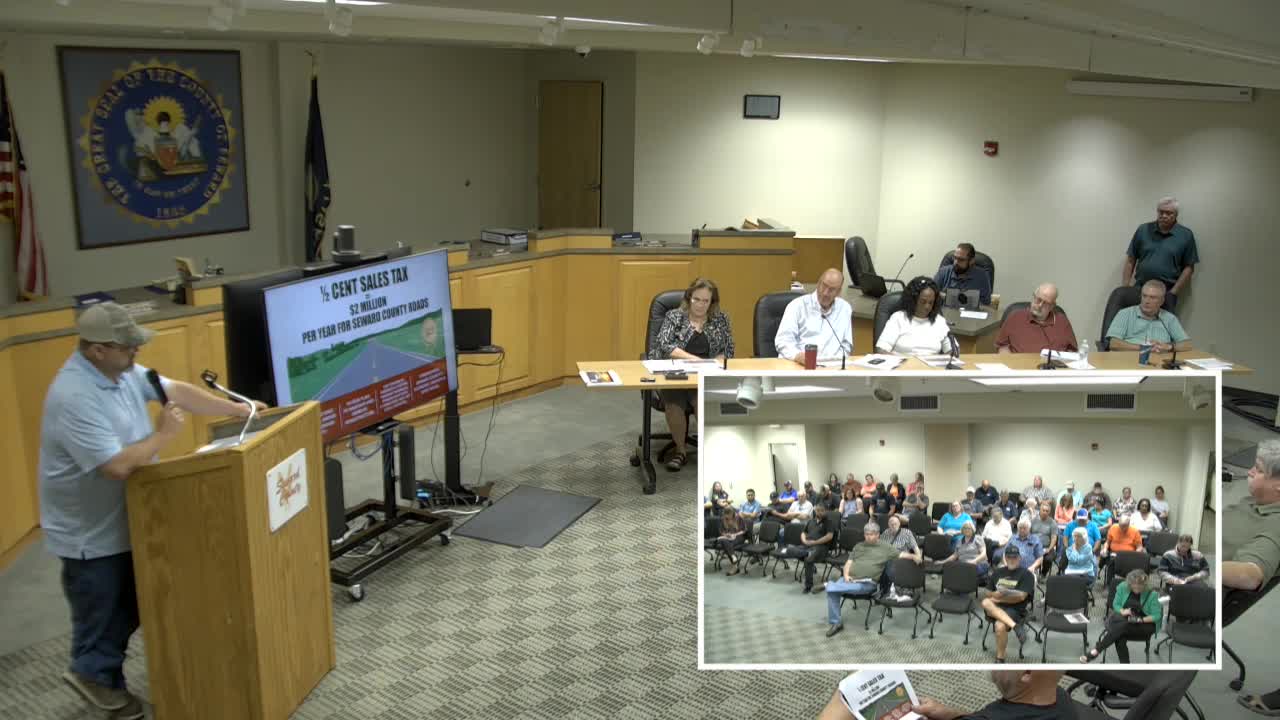

Seward County outlines worst-case $5.96 million tax payback as commissioners consider mill-levy increase

Seward County landfill described as regional enterprise; officials explain rates, reserves and closure fund