Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

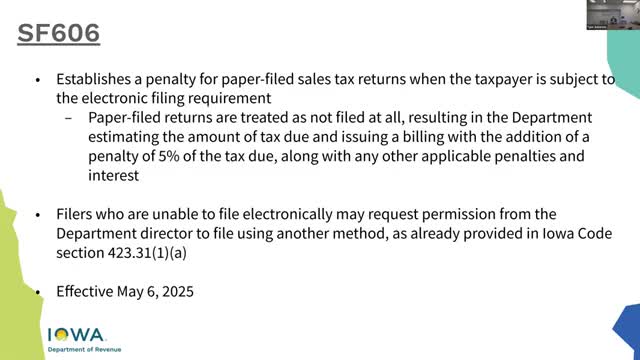

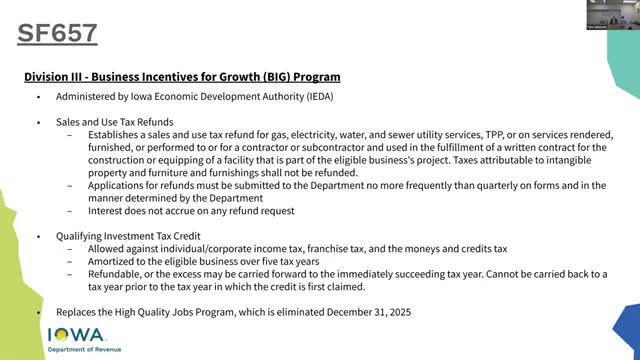

Iowa shifts major business tax credits to Economic Development Authority; new caps and programs set

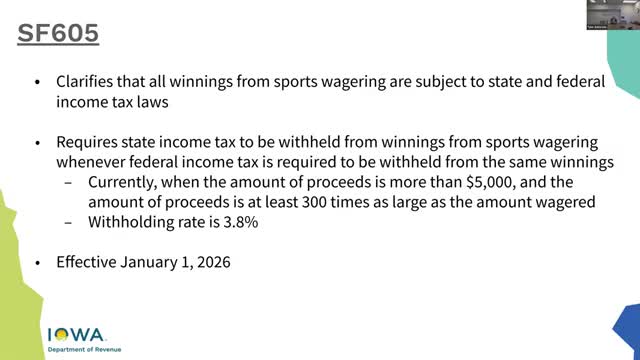

Iowa enacts sports-wagering withholding rule and updates for tobacco, alcohol and lottery operations