Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

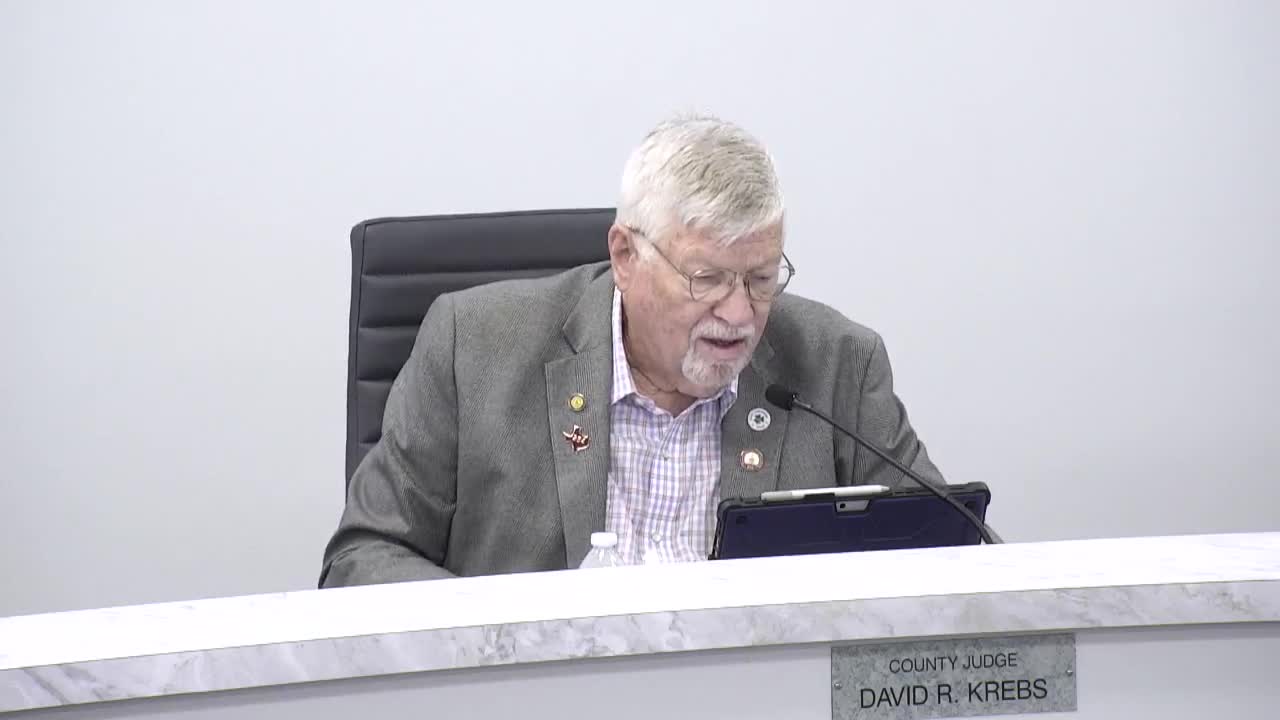

Commissioners approve $670 monthly prescription cap for county health plan

Commissioners approve consent agenda: interlocal animal control renewal, two environmental health vehicles and Civic Center floor change order

Commissioners approve list of new positions and 4% cost‑of‑living increase for county employees

County engineer reports slow but ongoing progress on ARPA-funded animal shelter, juvenile center, fiber optic and generator projects

San Patricio County sets proposed tax rates and schedules Aug. 25 public meeting