California Representative Critiques Bill for Rewarding Billionaires Over Child Welfare

July 27, 2025 | Ways and Means: House Committee, Standing Committees - House & Senate, Congressional Hearings Compilation

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

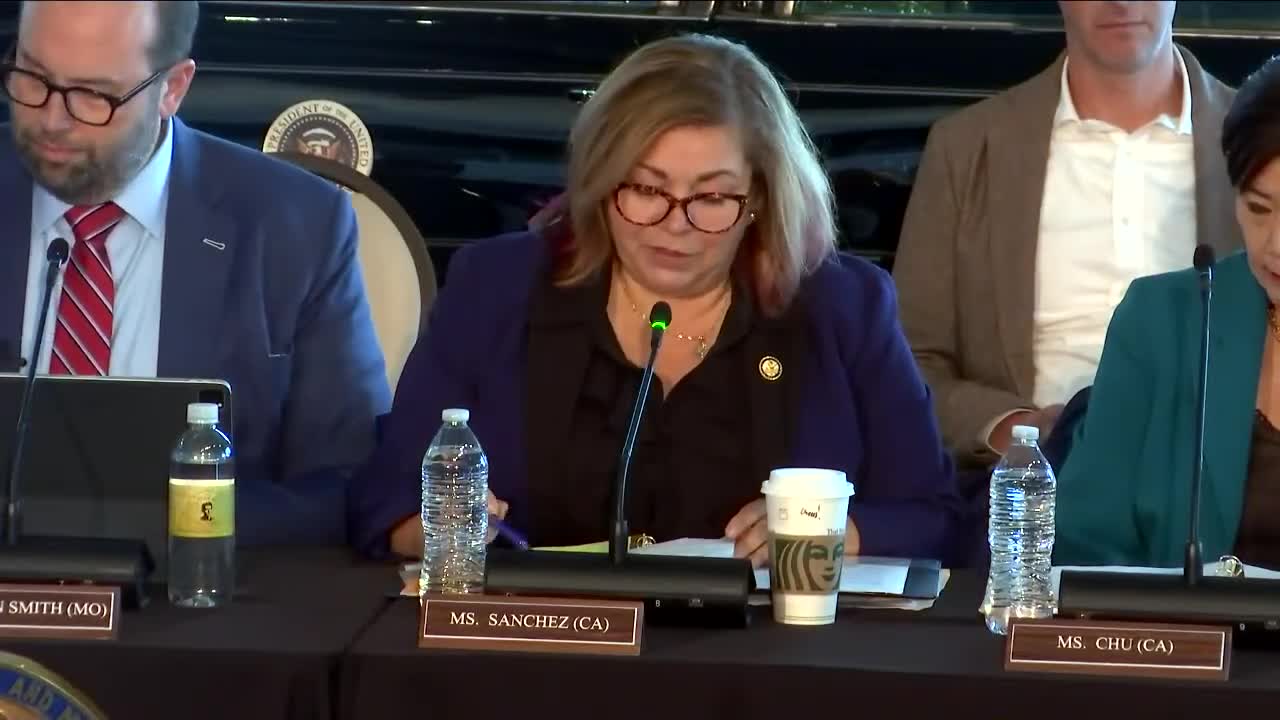

A heated debate erupted during the U.S. House Committee on Ways & Means meeting as lawmakers scrutinized the implications of a proposed bill that critics argue disproportionately benefits the wealthiest Americans while neglecting vulnerable populations.

Key discussions highlighted that the legislation would provide an average tax cut of $309,000 to the top 0.1% by 2037, raising concerns about its impact on child poverty. In Los Angeles County, where the child poverty rate stands at 17.7%, advocates questioned what families could achieve with such substantial tax relief for billionaires instead of directing funds to those in need. “Imagine if that money was going to children in poverty instead,” one lawmaker stated, emphasizing the stark contrast between the tax breaks for the wealthy and the meager benefits for low-income families.

Critics pointed out that the proposed expansion of benefits for families earning under $50,000 amounts to a mere 68 cents a day, far from sufficient to lift children out of poverty. They argued that if the financial priorities were reversed, working families could receive hundreds of dollars daily in support.

The bill also faces backlash for its potential to raise healthcare premiums and cut coverage for over 17 million Americans, particularly affecting children enrolled in the Children's Health Insurance Program (CHIP). Lawmakers expressed alarm that the legislation could lock children out of essential healthcare services and impose limits on care, further exacerbating the healthcare crisis in rural areas.

Additionally, the bill is projected to trigger $500 billion in cuts to Medicare, raising fears about the future of long-term care for the elderly and individuals with disabilities. Critics accused Republican lawmakers of prioritizing tax cuts for the wealthy while neglecting the needs of their constituents, particularly those reliant on Medicaid.

As the meeting concluded, the divide between the priorities of the wealthy and the needs of everyday Americans became increasingly evident, leaving many to wonder about the long-term consequences of such fiscal policies. The debate continues as lawmakers grapple with the implications of this significant legislation.

Key discussions highlighted that the legislation would provide an average tax cut of $309,000 to the top 0.1% by 2037, raising concerns about its impact on child poverty. In Los Angeles County, where the child poverty rate stands at 17.7%, advocates questioned what families could achieve with such substantial tax relief for billionaires instead of directing funds to those in need. “Imagine if that money was going to children in poverty instead,” one lawmaker stated, emphasizing the stark contrast between the tax breaks for the wealthy and the meager benefits for low-income families.

Critics pointed out that the proposed expansion of benefits for families earning under $50,000 amounts to a mere 68 cents a day, far from sufficient to lift children out of poverty. They argued that if the financial priorities were reversed, working families could receive hundreds of dollars daily in support.

The bill also faces backlash for its potential to raise healthcare premiums and cut coverage for over 17 million Americans, particularly affecting children enrolled in the Children's Health Insurance Program (CHIP). Lawmakers expressed alarm that the legislation could lock children out of essential healthcare services and impose limits on care, further exacerbating the healthcare crisis in rural areas.

Additionally, the bill is projected to trigger $500 billion in cuts to Medicare, raising fears about the future of long-term care for the elderly and individuals with disabilities. Critics accused Republican lawmakers of prioritizing tax cuts for the wealthy while neglecting the needs of their constituents, particularly those reliant on Medicaid.

As the meeting concluded, the divide between the priorities of the wealthy and the needs of everyday Americans became increasingly evident, leaving many to wonder about the long-term consequences of such fiscal policies. The debate continues as lawmakers grapple with the implications of this significant legislation.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting