Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

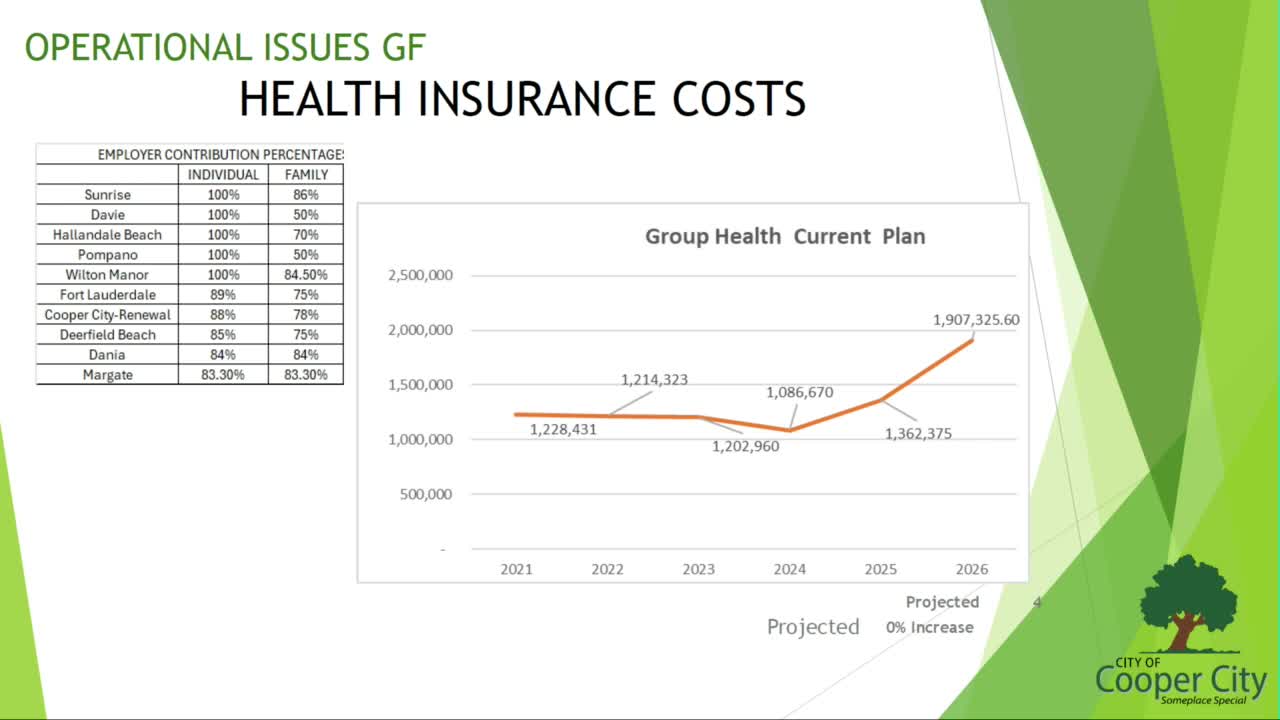

Cooper City managers propose switching health plan, budget for 30% premium rise and a reserve to smooth future spikes

Commissioners hear resident complaints about FPL subcontractors; manager to pursue enforcement and potential permit action

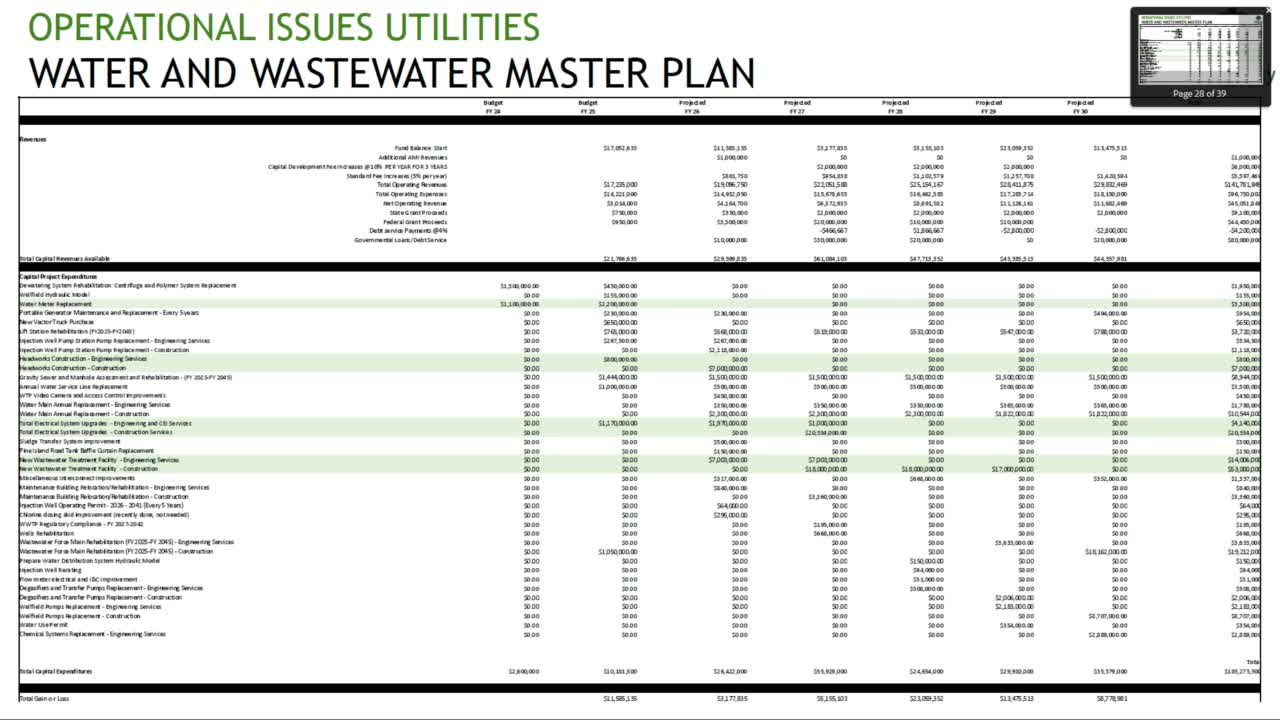

Manager outlines water/sewer capital plan, meter rollout and park projects in FY26 budget preview

Commissioners advance study and visible markings for Hyattice/NE Lake Boulevard traffic calming; roundabout remains under consideration

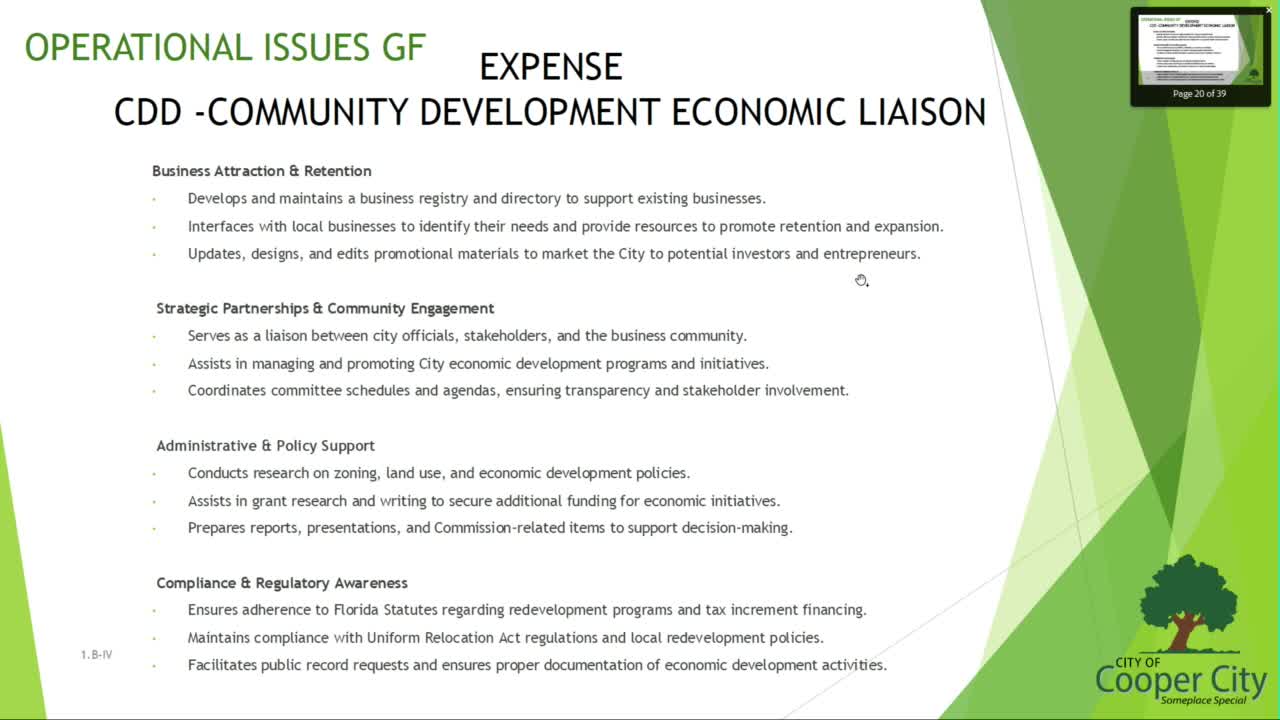

Commissioners discuss adding economic‑development liaison and a more robust communications/IT function