Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

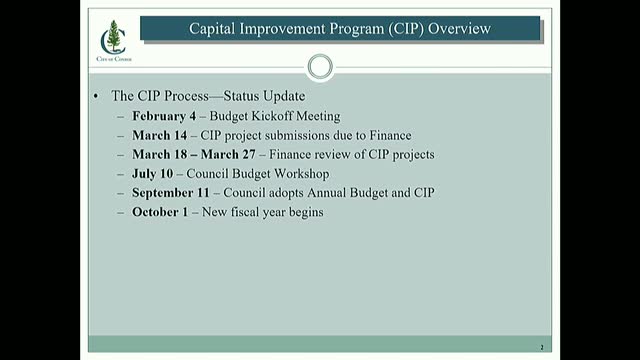

Conroe reviews five‑year CIP with $375M in proposed water and sewer debt; council orders wastewater alternatives study

Conroe council reviews FY2026 budget, directs staff to model pay scenarios after months of hiring freezes