Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

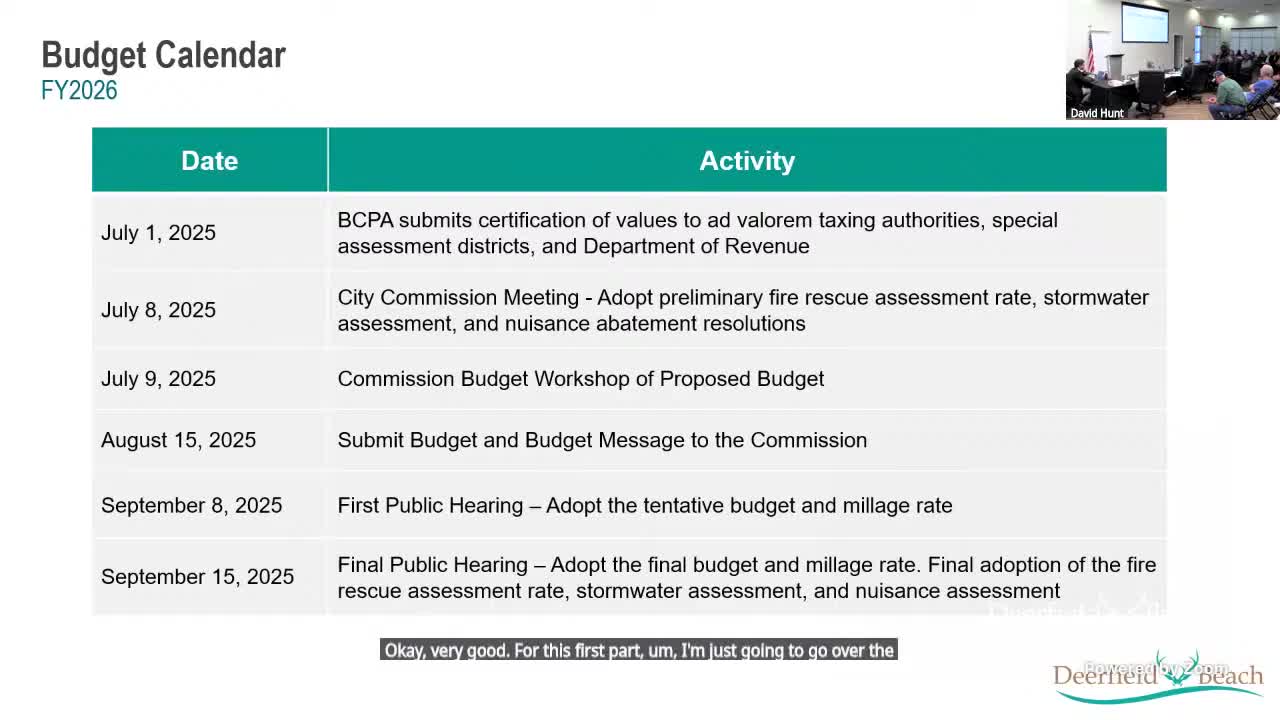

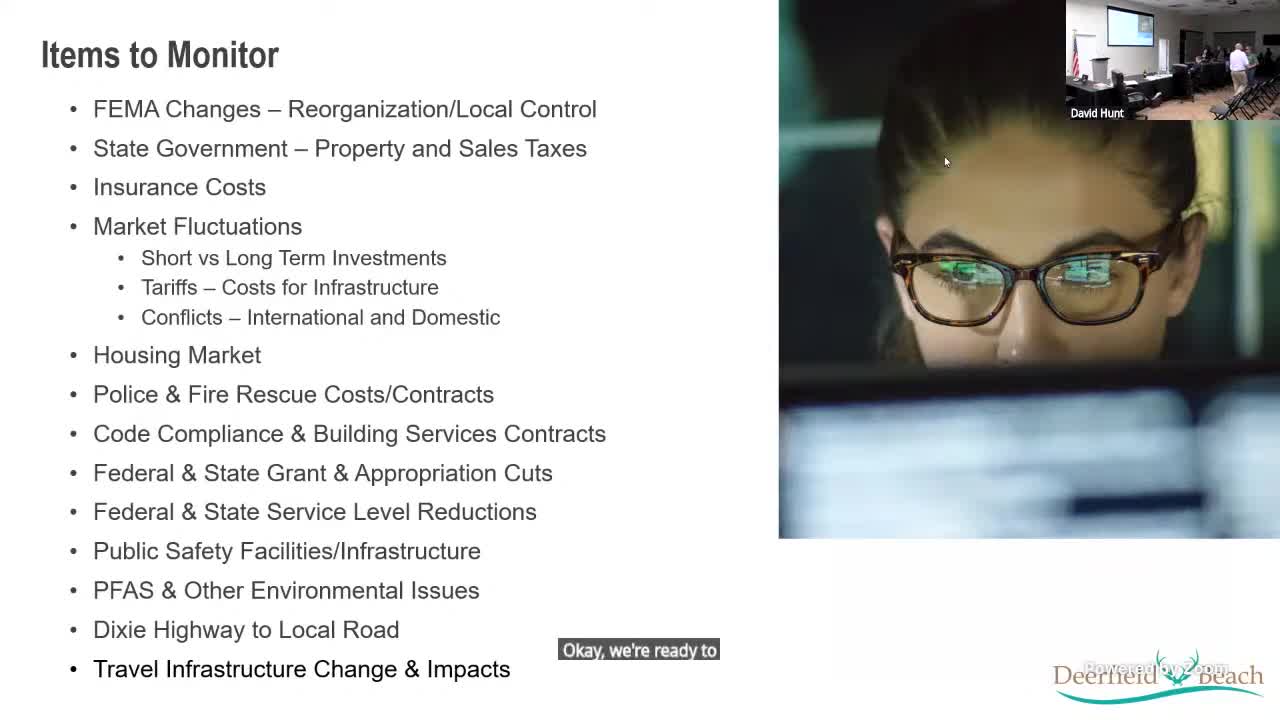

Deerfield Beach trims capital plan, keeps FY2026 projects that match available funding; parks/events budget sparks debate

Financial adviser: Deerfield Beach holds AA ratings and has debt capacity, but affordability should guide CIP decisions

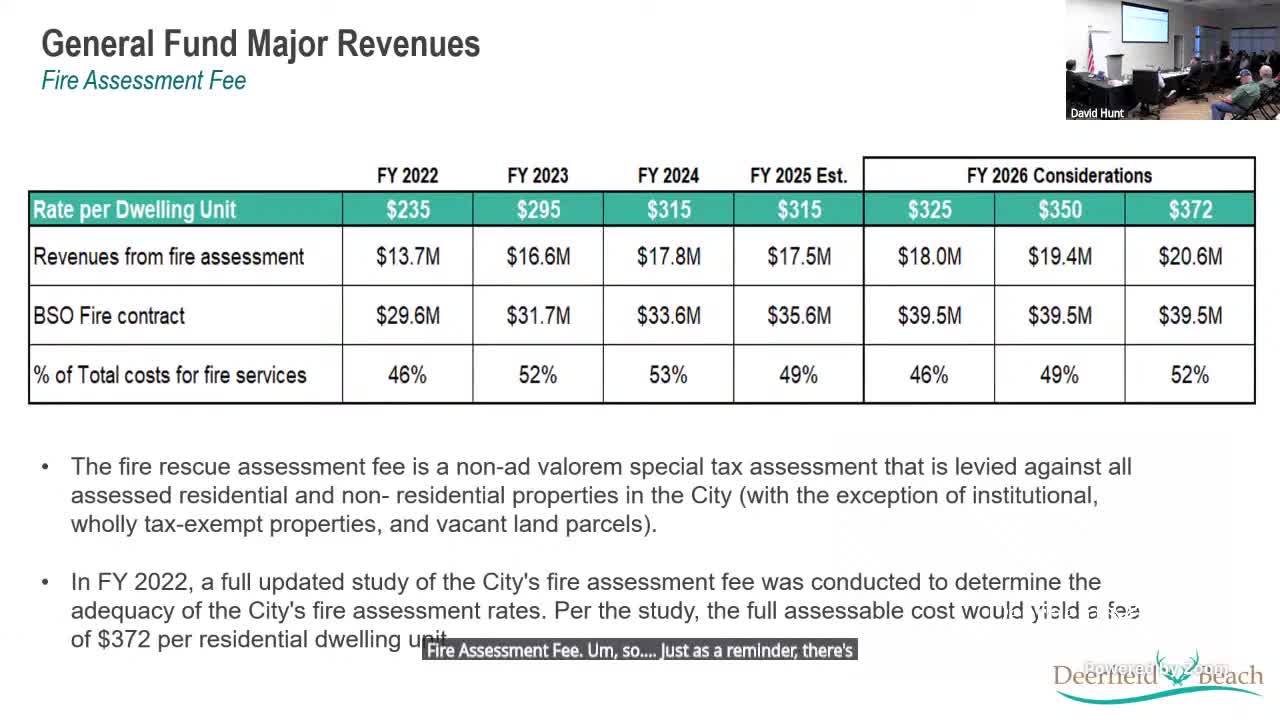

Deerfield Beach grapples with growing BSO contract costs; fire assessment covers limited portion of contract