Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

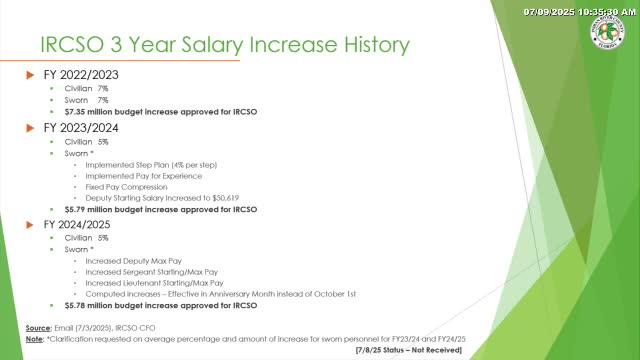

Indian River County proposes $597.6 million FY2026 budget and sets proposed millage rates

Supervisor of Elections warns new state petition-notice law will raise verification costs

County planning to assume animal services as Humane Society contract ends; $1.3 million estimate presented

County projects big landfill and recycling cost spike; universal collection assessment proposed