Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

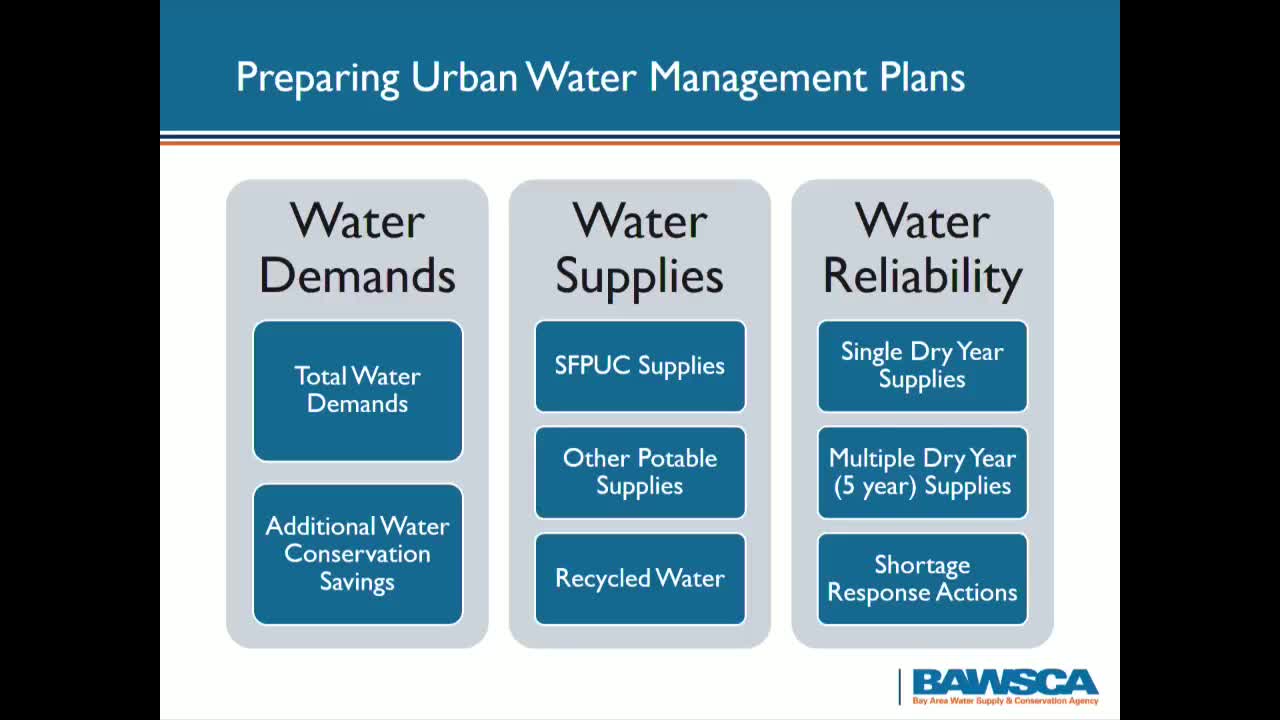

BAWSCA briefs SFPUC on wholesale customers' demand study and the 184 million‑gallons supply assurance

SFPUC outlines FY21–22 budget timetable, flags recruitment and resilience themes

SFPUC reports progress on Hetch Hetchy repairs, warns some work to be rebid

Votes at a glance: SFPUC Nov. 26 actions include debt policy, $850M taxable refunding, grant‑rule changes and land transactions