Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

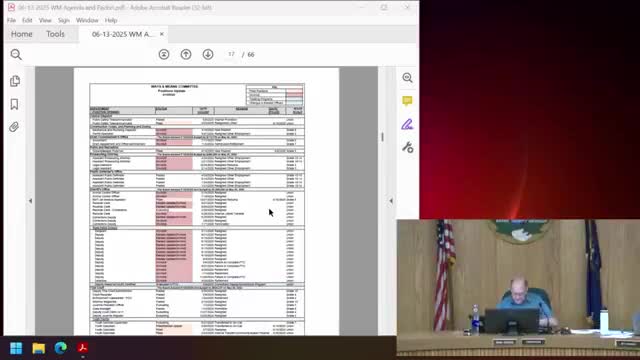

Human Resources report: vacancies, central dispatcher hire authorized; MERS study may extend amortization

Eaton County board adopts 10% minimum fund-balance policy to stabilize finances

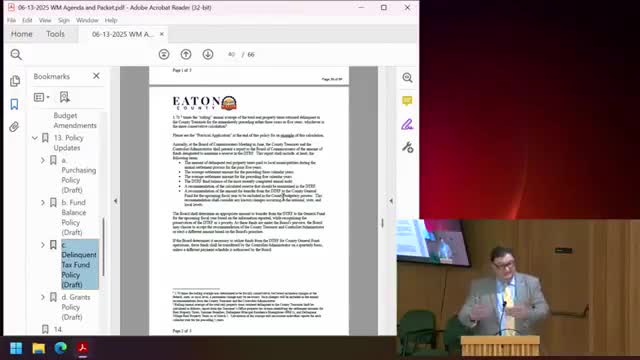

Board sets rules for transfers from delinquent-tax fund; staff to use formula before recommending surplus transfers

Eaton County adopts grant policy; staff to collect 15% admin fee to support county services

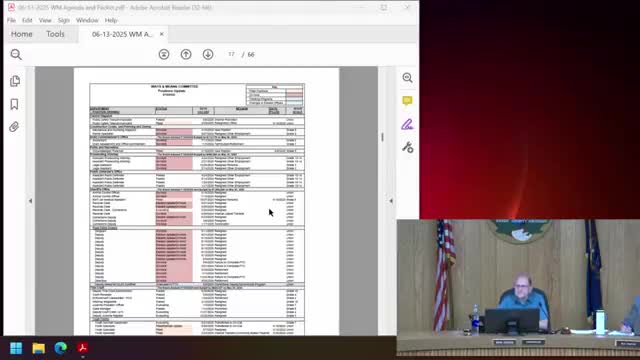

County staff says proposed head-count reductions and revenue adjustments produce an adoptable budget; commissioners warned not to "rest" on cuts

Technology services director outlines cost per-user impacts of proposed staffing cuts

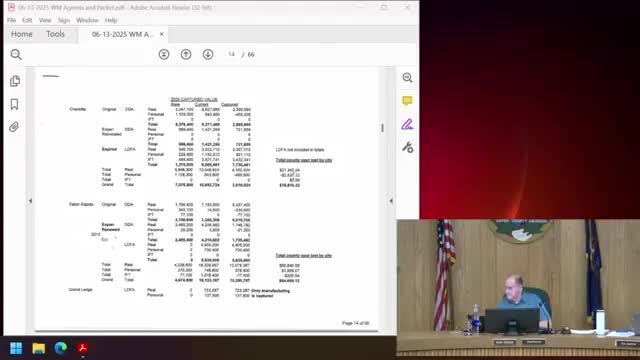

Equalization director details $983,000 annual tax revenue loss from development capture districts

Conservation District meadow project and Bridal Park access move forward; jail generator fixed