Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Assembly hearing explores TNCs’ approach to autonomous vehicles and future platform mixes

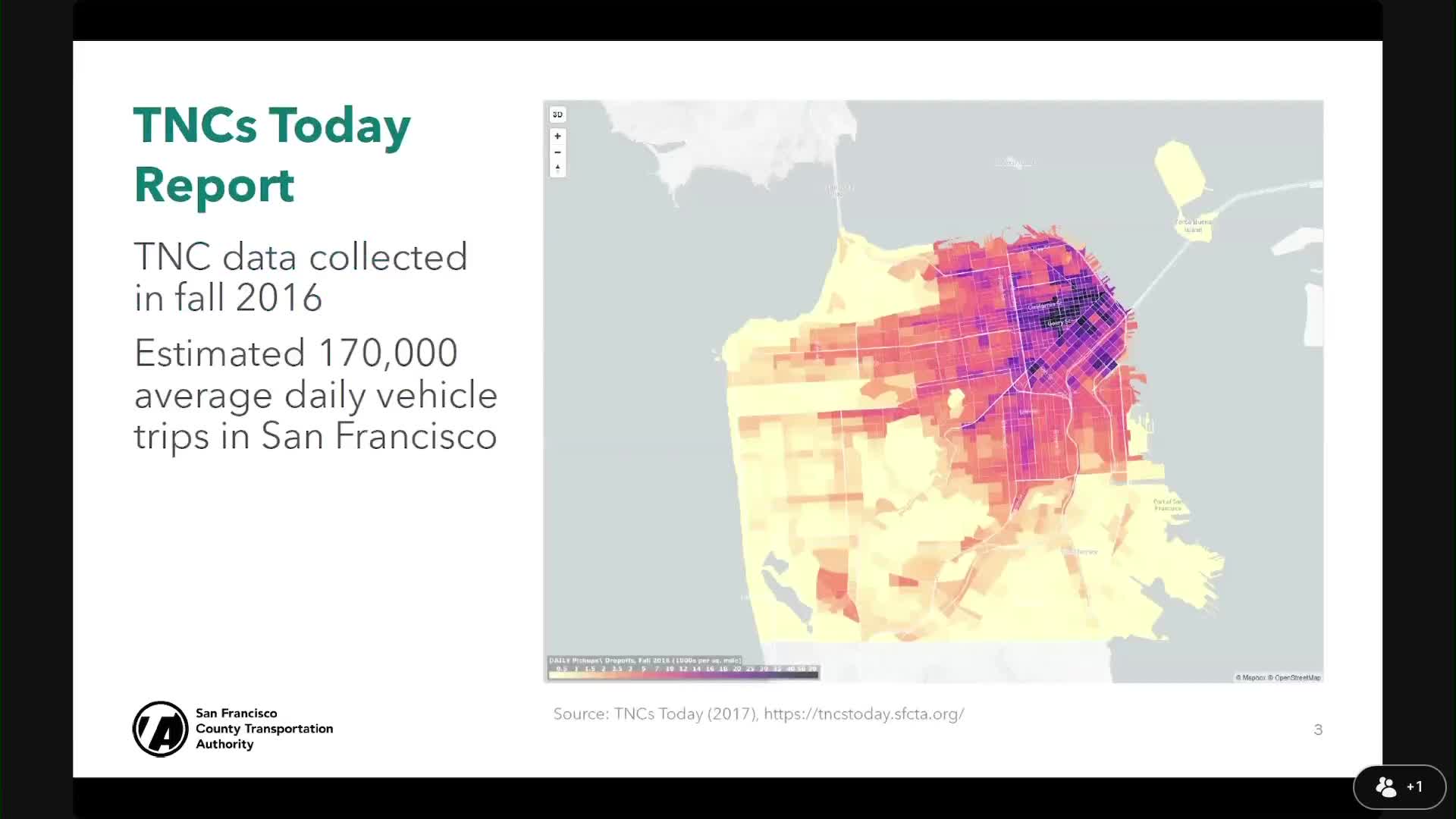

San Francisco research, local officials tell Assembly TNCs contributed to congestion and transit ridership declines

TNC insurance costs and the uninsured/underinsured motorist debate draw scrutiny

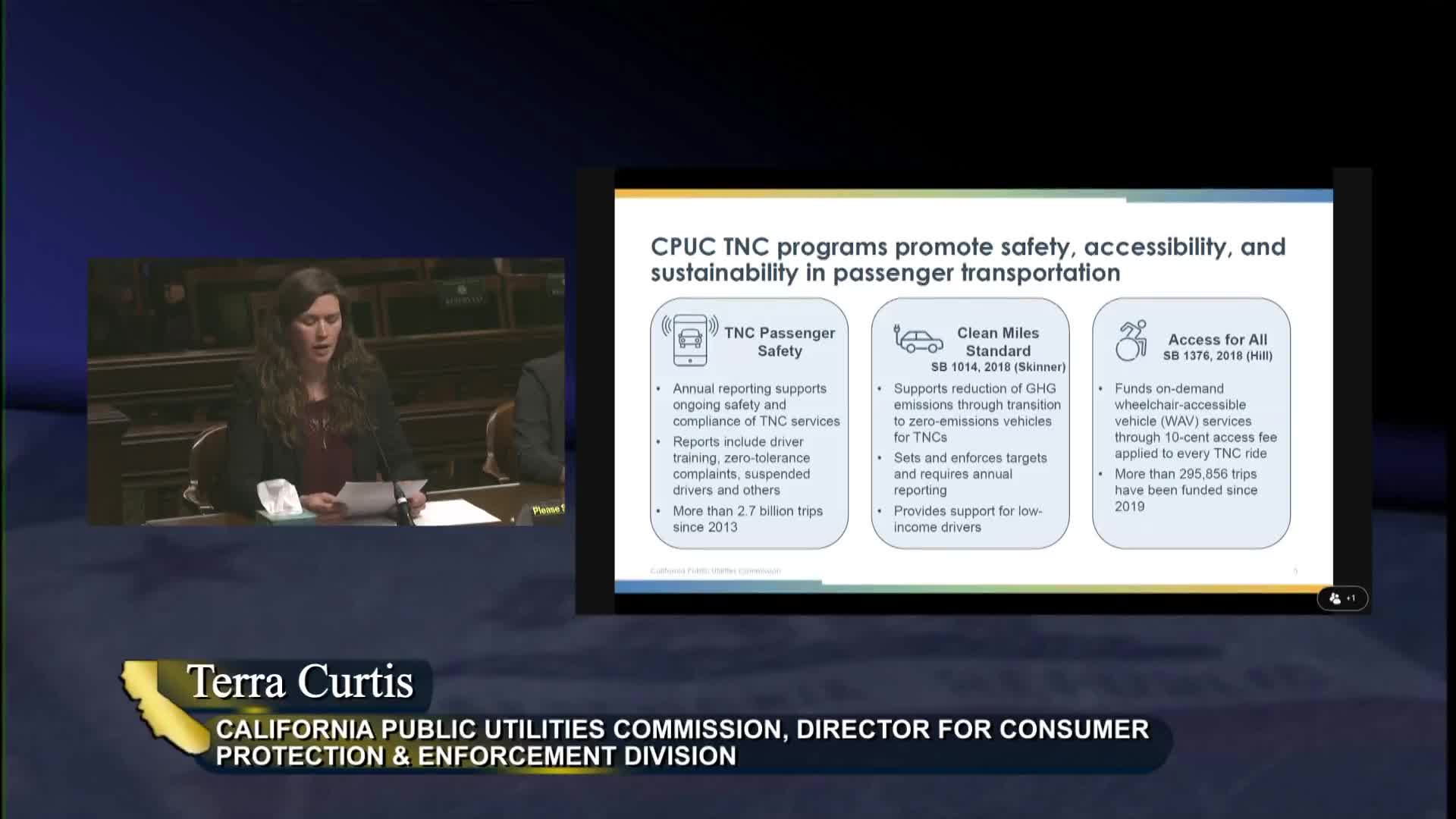

CPUC and TNCs report on Access for All wheelchair‑accessible trips and funding

Lawmakers and industry debate rollout of California's Clean Miles Standard and driver incentives