Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

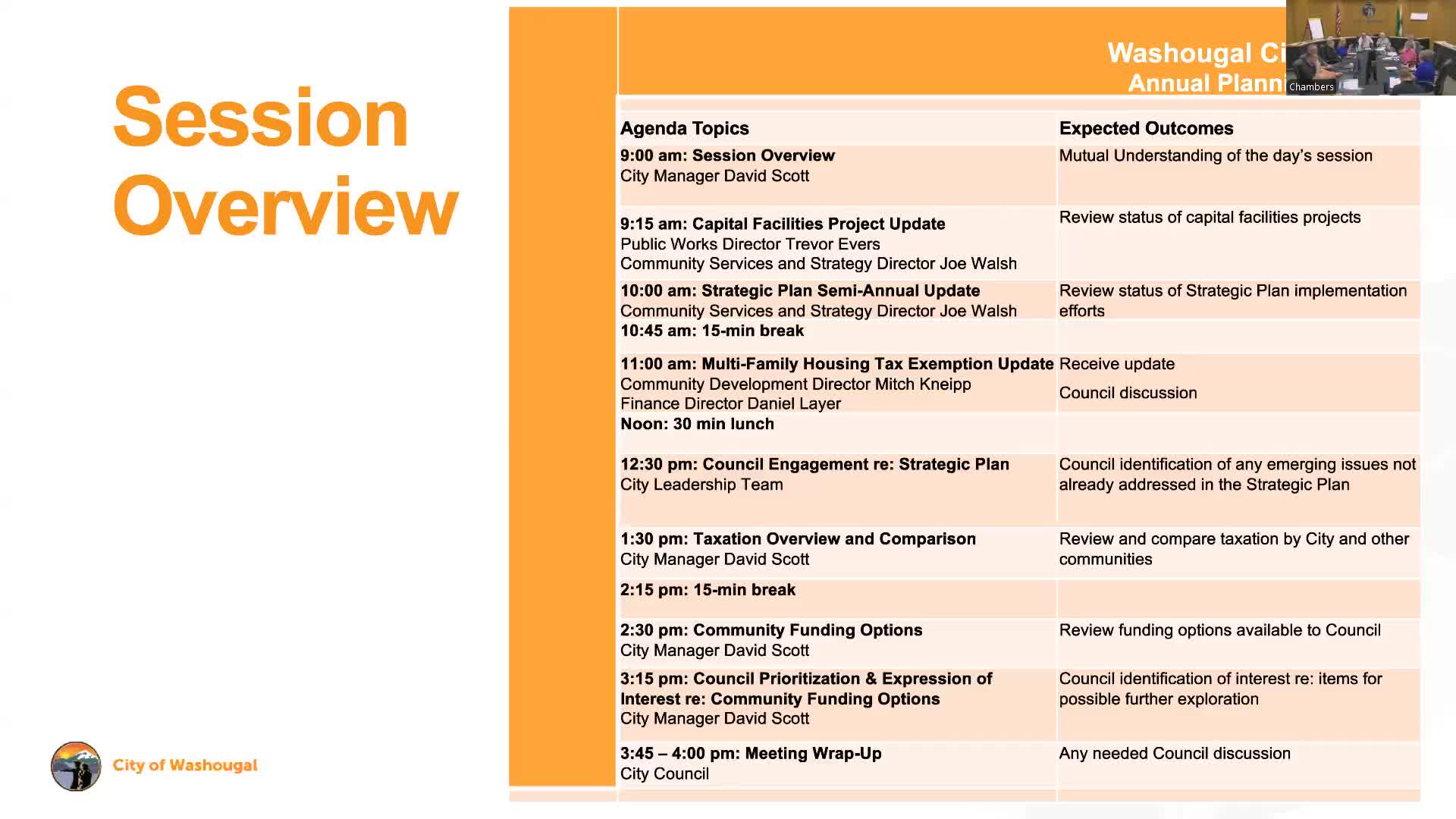

Washougal staff update council on Schmidt Family Park, town‑center revitalization and veterans memorial

Council discusses multifamily tax‑exemption program; staff outline tradeoffs and affordability options

Washougal council hears midterm strategic‑plan update; staff to seek council input on community funding options