Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

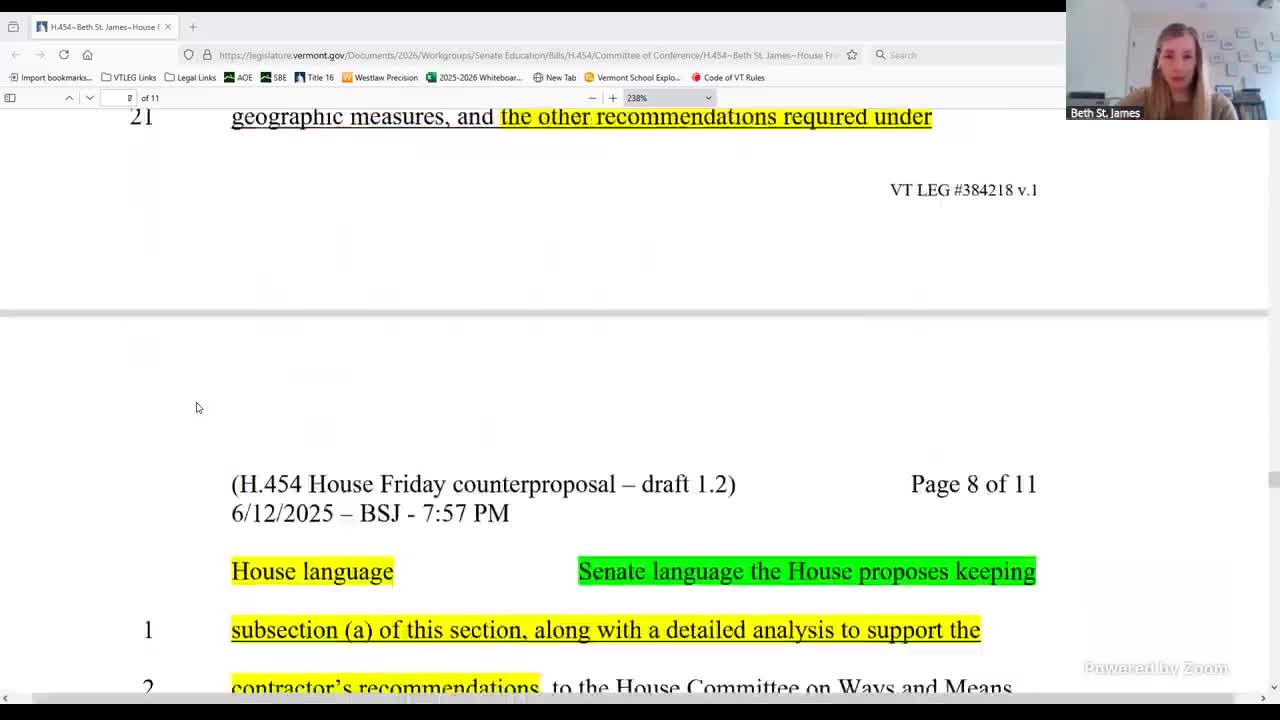

Conference draft increases study funding and sets Agency of Education transformation appropriation

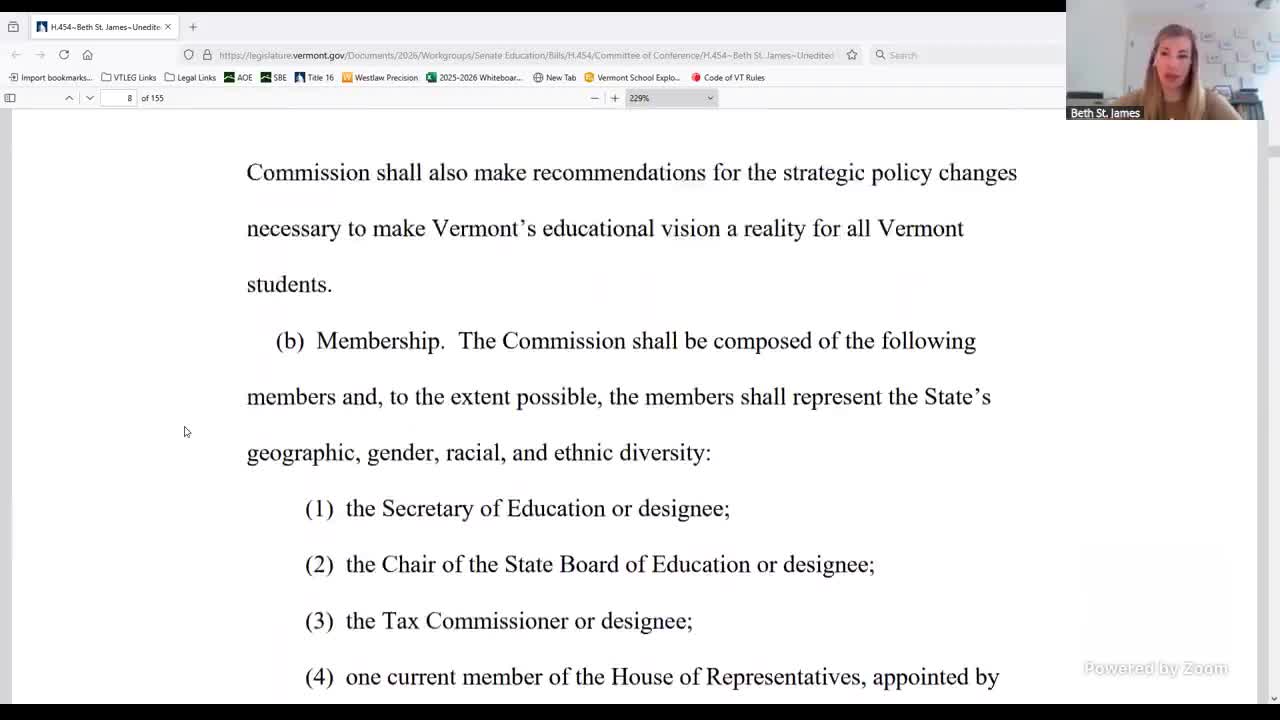

Committee sets new commissions and task forces on district boundaries, voting wards and class-size minimums

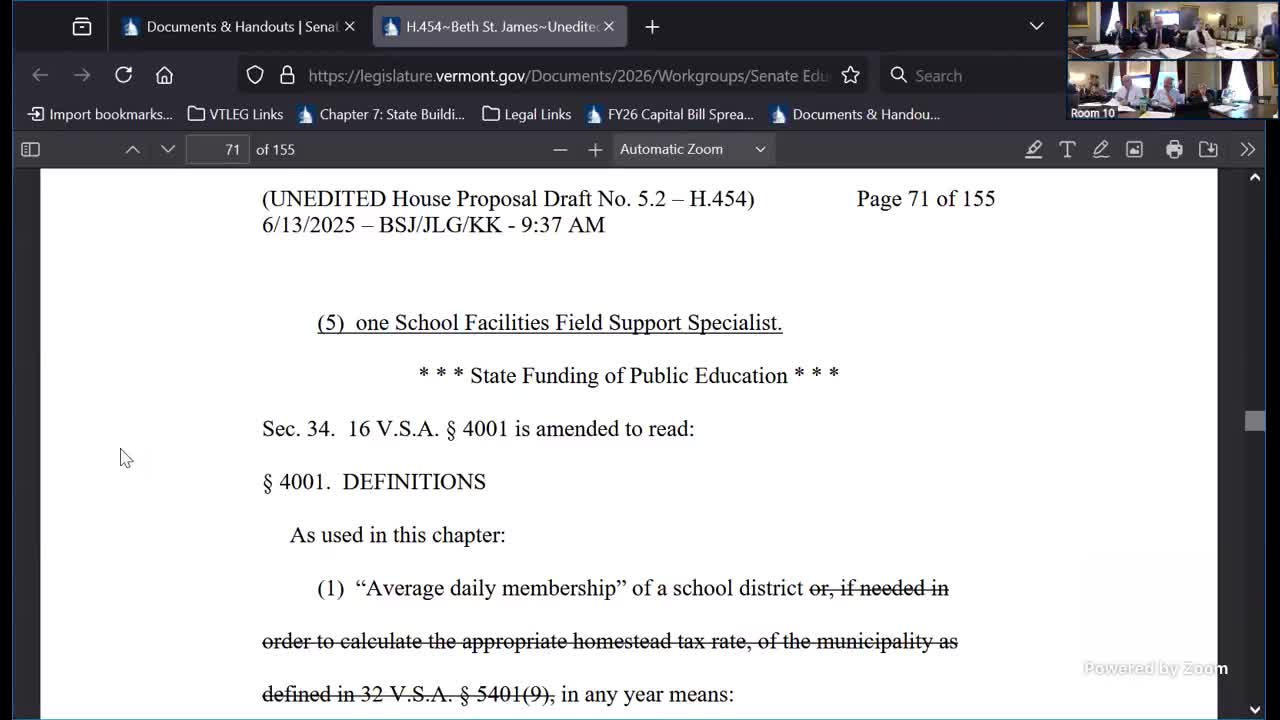

Conference draft sets foundation-formula mechanics, new homestead exemption and tax-classification study

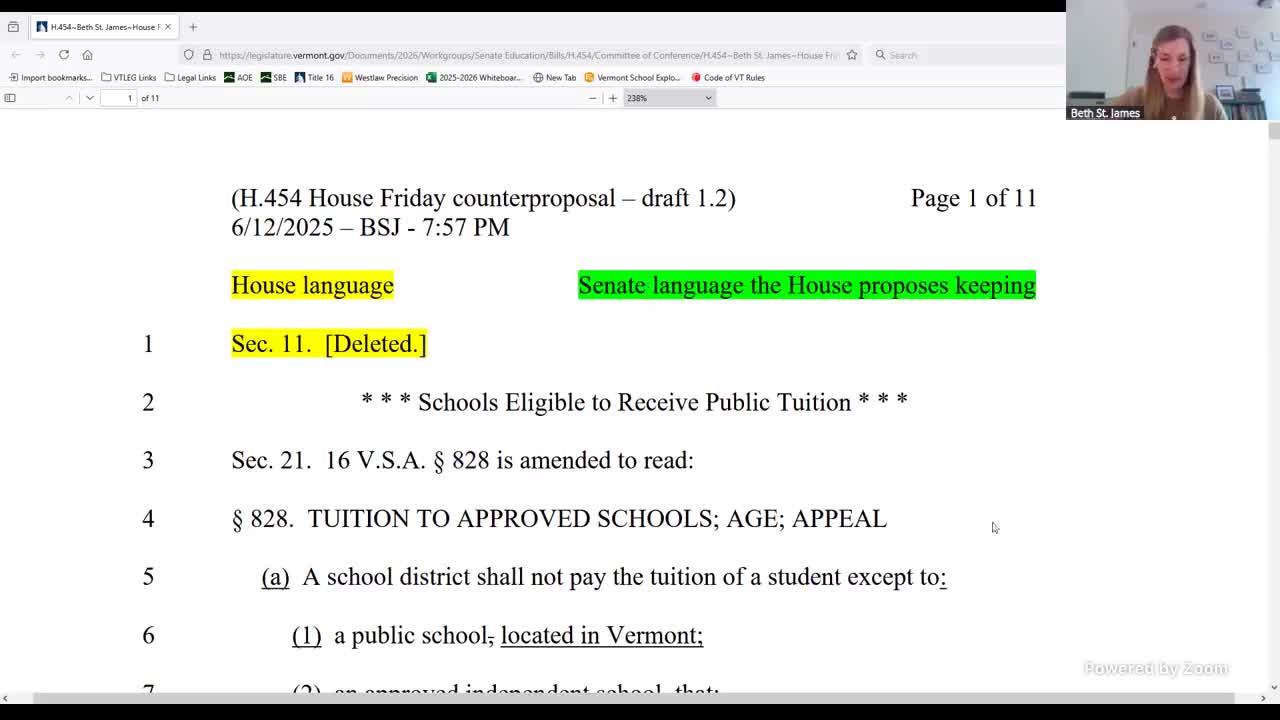

Conference draft narrows eligibility for public tuition to approved independent schools, allows limited supplemental fee for secondary grades