Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

APCA presents FY26 budget, details cannabis enforcement and explains a contested placard rescission

Lottery director outlines central gaming system procurement, warns on offshore ‘sweepstakes’ and describes new games proposals

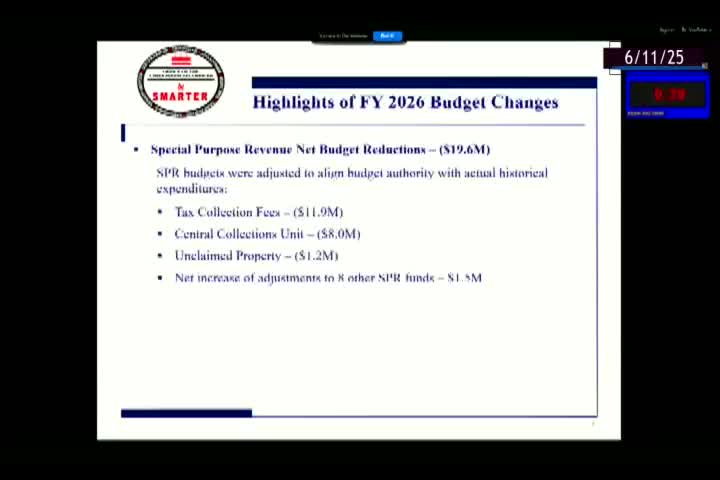

DC CFO outlines FY26 spending cuts, IT and tax initiatives as reserves are drawn down