Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Experts tell Senate to expand mental‑health resources for farmers; FarmNet cited as model

Growers and senators press trade officials as cheaper imports undercut U.S. produce

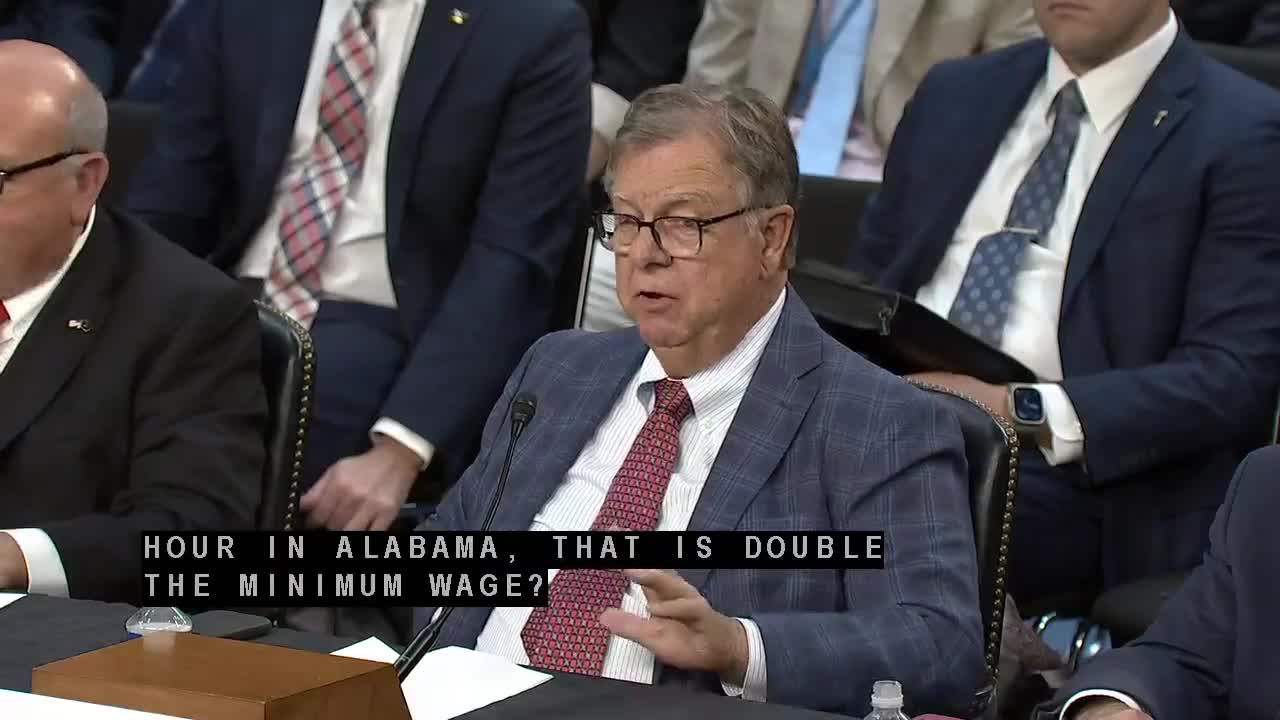

Farmers tell Senate H-2A program, wage survey and housing costs are squeezing operations