Weatherford Council reviews $148M utility debt increase amid citizen concerns

April 22, 2025 | Weatherford, Weatherford, Texas

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

Weatherford City Council members faced a critical discussion on the city's financial future during their April 22 meeting, as concerns over a significant increase in utility debt took center stage. The council is considering a bond issuance that could raise the total utility debt from $26.8 million to a staggering $148.2 million, marking a 553% increase.

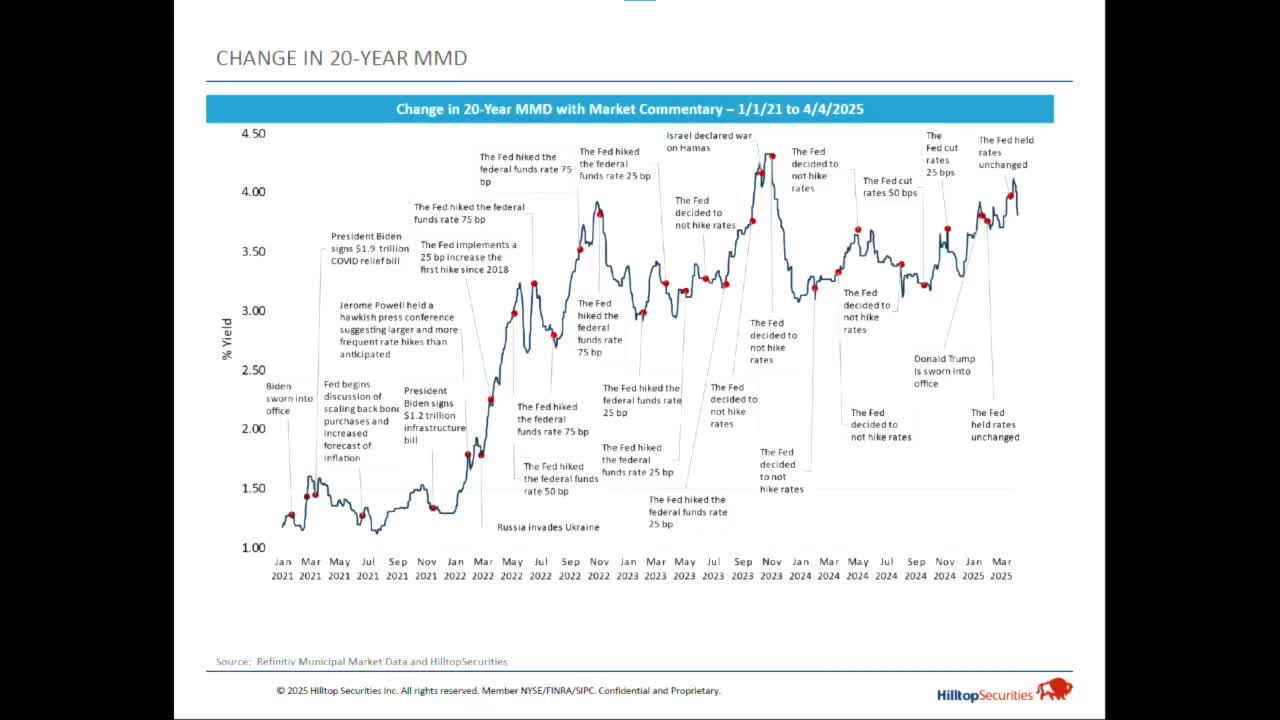

Financial advisor Miss Shue presented preliminary estimates, indicating that interest rates for the bonds could range from 4.2% to 4.5%. She emphasized that despite current market volatility, these rates remain historically attractive for financing such a large project. "Hopefully we'll get some stabilization and rates will continue to move in your favor," she noted, assuring council members that she would return for final approval and pricing in the coming months.

However, public sentiment was palpable as resident Lynn Baber voiced her disappointment over the perceived lack of engagement with citizens regarding the bond proposal. Speaking from the audience, Baber criticized the council for not providing adequate information to the public, contrasting the current situation with the more robust communication seen during a previous transportation bond initiative in Parker County. "There isn't even a plain English package of information that explains to citizens what they're gonna get from this," she lamented.

The council's decision on the bond issuance will have significant implications for Weatherford's financial landscape, and the call for greater transparency and public involvement is likely to resonate as discussions progress. As the city navigates these financial waters, the outcome of this bond proposal will be closely watched by both council members and the community at large.

Financial advisor Miss Shue presented preliminary estimates, indicating that interest rates for the bonds could range from 4.2% to 4.5%. She emphasized that despite current market volatility, these rates remain historically attractive for financing such a large project. "Hopefully we'll get some stabilization and rates will continue to move in your favor," she noted, assuring council members that she would return for final approval and pricing in the coming months.

However, public sentiment was palpable as resident Lynn Baber voiced her disappointment over the perceived lack of engagement with citizens regarding the bond proposal. Speaking from the audience, Baber criticized the council for not providing adequate information to the public, contrasting the current situation with the more robust communication seen during a previous transportation bond initiative in Parker County. "There isn't even a plain English package of information that explains to citizens what they're gonna get from this," she lamented.

The council's decision on the bond issuance will have significant implications for Weatherford's financial landscape, and the call for greater transparency and public involvement is likely to resonate as discussions progress. As the city navigates these financial waters, the outcome of this bond proposal will be closely watched by both council members and the community at large.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting