Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

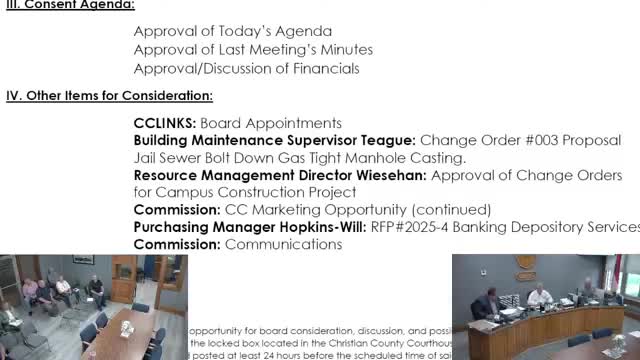

Commission declines Dennis Quaid/Show Me Christian County marketing opportunity for 2025

Commission reappoints three officers to Christian County Links board

Christian County approves three construction change orders totaling about $117,000; commissioners urge better city-county coordination