Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

CREC adopts revised Medicaid and human-services caseload and cost estimates; large gross increases noted for DHHS

CREC adopts higher child-care caseload estimate; state staff project growing demand and increased general-fund costs in 2026

CREC adopts updated K-12 membership counts; state projects continued enrollment decline

CREC adopts revised revenue consensus; general fund projections trimmed, school-aid fund modestly higher

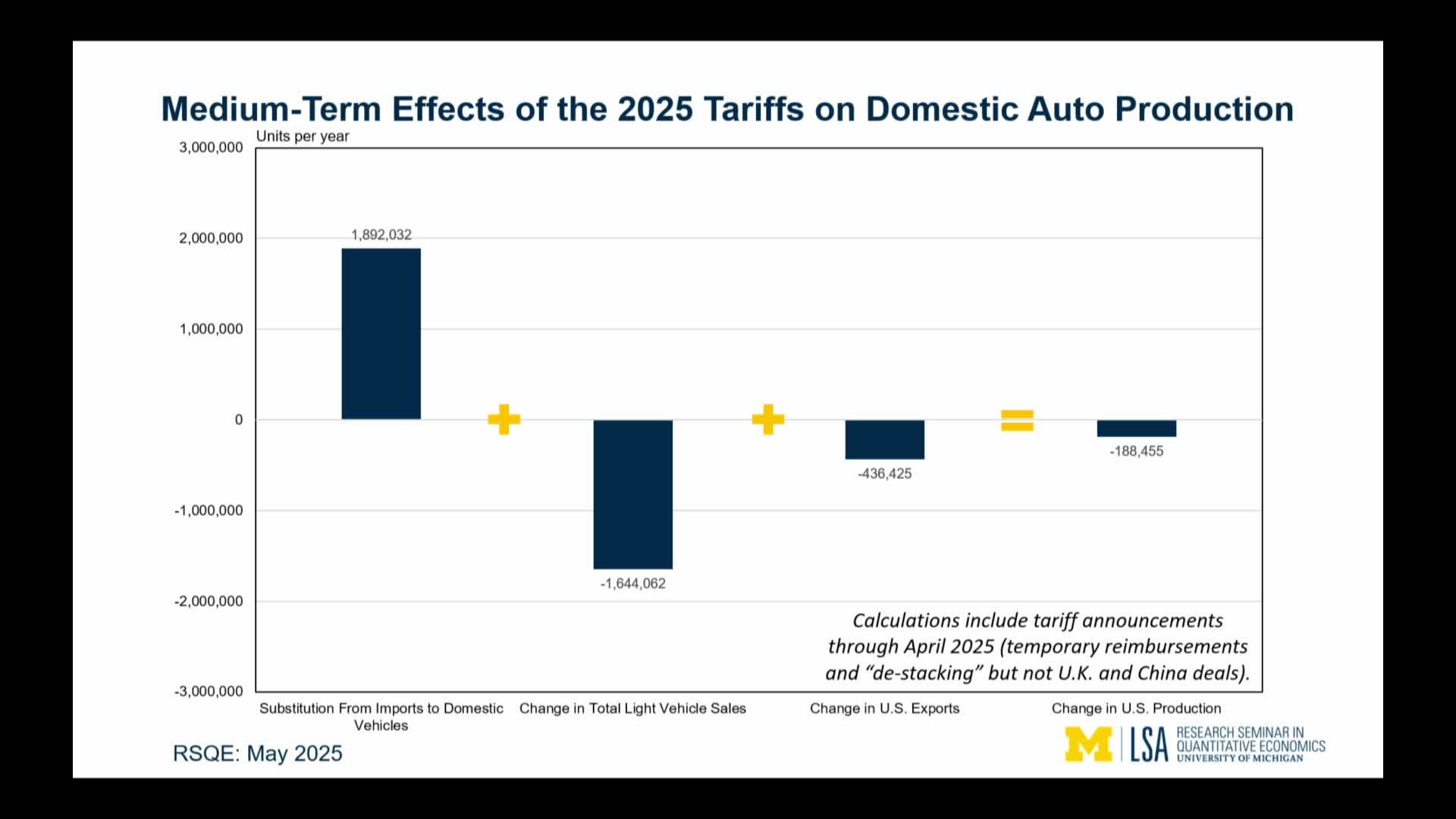

Tariffs, supply-chain pinch points and rare earth licensing raise risks for Michigan auto jobs, experts say