Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

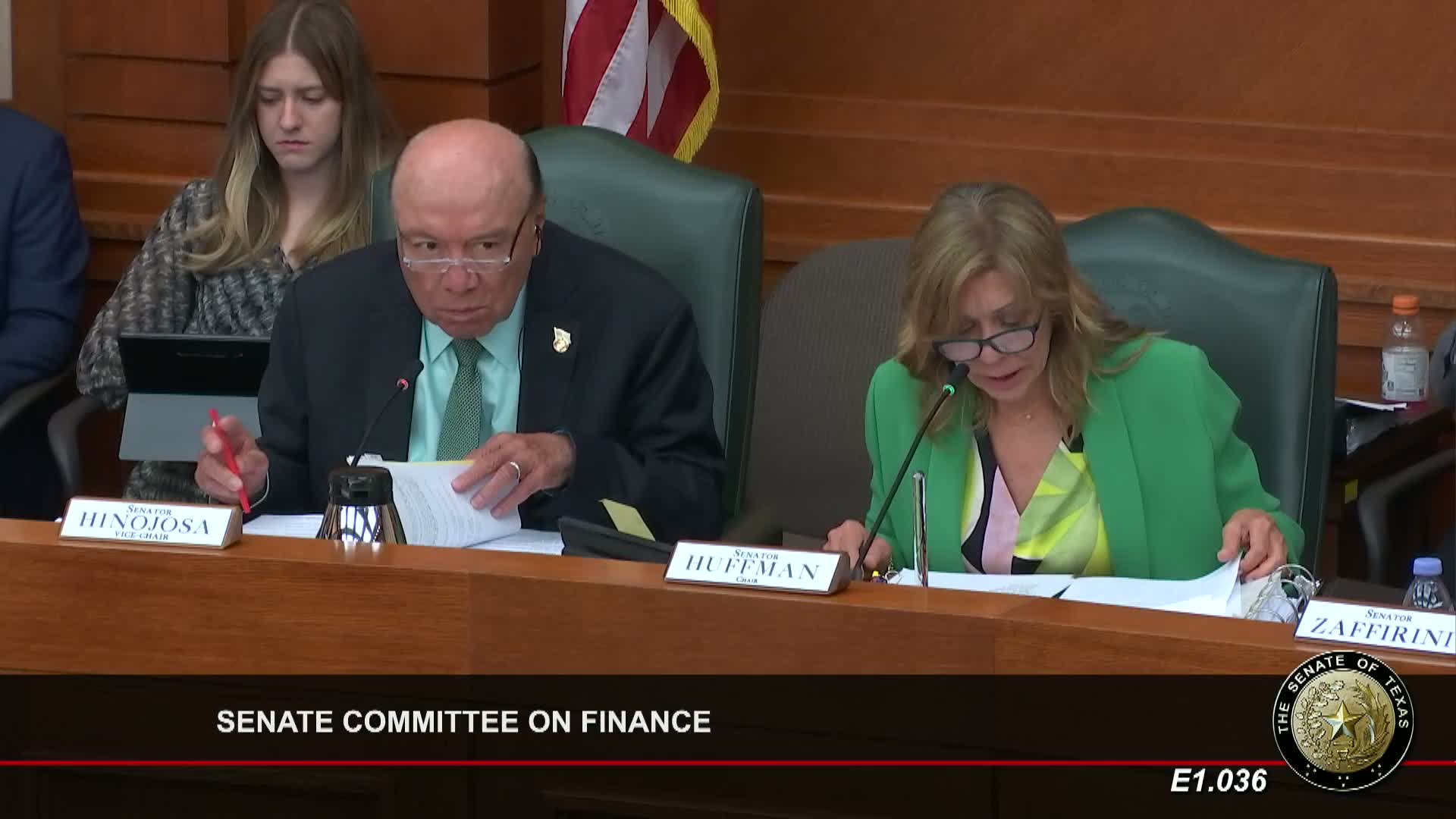

Senate committee advances local bill to simplify San Antonio retiree health contributions and survivor rules

Committee grills depository plan for gold-and-silver debit card as stakeholders raise security, fiscal, and regulatory concerns

Panel backs voluntary driver-license donations to fund nonprofits aiding DPS officers

Senate committee debates tax break for restimulating inactive oil wells; fiscal note and scope questioned