Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Committee hears analysis showing large gap between local incomes and housing costs in Sawyer County

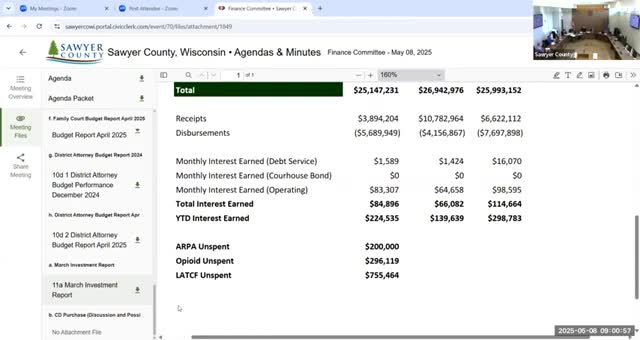

Finance committee approves purchase of CD with Ampersand to replace maturing Franzen CD

Sawyer County treasurer reports foreclosure timeline as delinquent list shrinks to 14 parcels