Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

County council approves amendment extending Oak Ridge Landfill development rights; moves forward on tax repeal first reading and budget referral

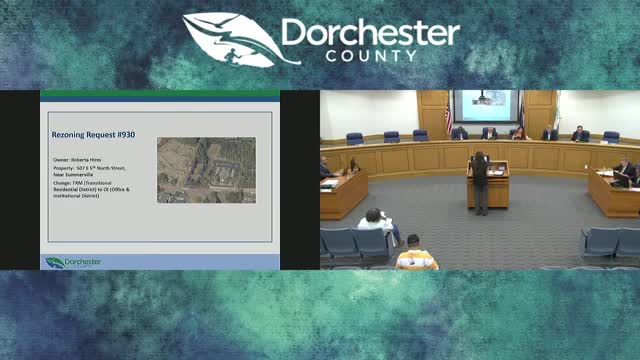

Dorchester planning committee backs three land-use changes, including rezoning near Rusty’s Driving School