Congressional leaders criticize Trump for undermining CDFIs and consumer protections

April 29, 2025 | Financial Services: House Committee, Standing Committees - House & Senate, Congressional Hearings Compilation

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

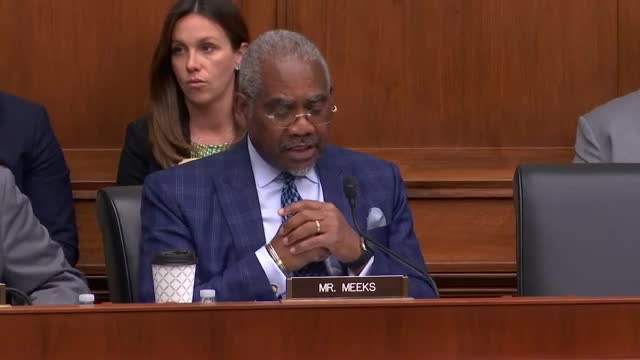

During a recent meeting of the U.S. House Committee on Financial Services, lawmakers expressed significant concerns regarding regulatory overreach and its potential impact on American consumers and community financial institutions. Central to the discussion was the Consumer Financial Protection Bureau (CFPB), which has garnered bipartisan support for its role in protecting consumers from unfair financial practices.

Committee members highlighted the CFPB's success in returning funds to harmed consumers and preventing exploitation by financial companies. They argued that efforts to eliminate or weaken the agency contradict promises made by President Trump to lower costs for everyday Americans. Critics pointed out that reducing consumer protections could lead to increased fees on essential services like credit cards, ultimately squeezing consumers financially.

The conversation also touched on the Community Development Financial Institutions (CDFI) Fund, which supports underserved communities, both urban and rural. Lawmakers expressed alarm over President Trump's executive order that aimed to undermine the CDFI Fund, emphasizing its critical role in promoting equity and supporting minority-owned businesses. For instance, Minority Depository Institutions (MDIs) represent only 2% of U.S. banks but serve over 30% of Black-owned businesses, showcasing their importance in fostering economic growth in diverse communities.

Members of the committee stressed the need for vigilance against any attempts to dismantle the CDFI Fund, noting that every dollar invested in CDFIs can leverage eight dollars in private sector investments. This efficiency underscores the fund's value in driving economic development.

As discussions continue, lawmakers are committed to empowering CDFIs and MDIs, ensuring they can continue to provide essential services to communities across the nation. The committee's focus on these issues reflects a broader concern about the implications of regulatory changes on American prosperity and the financial well-being of consumers.

Committee members highlighted the CFPB's success in returning funds to harmed consumers and preventing exploitation by financial companies. They argued that efforts to eliminate or weaken the agency contradict promises made by President Trump to lower costs for everyday Americans. Critics pointed out that reducing consumer protections could lead to increased fees on essential services like credit cards, ultimately squeezing consumers financially.

The conversation also touched on the Community Development Financial Institutions (CDFI) Fund, which supports underserved communities, both urban and rural. Lawmakers expressed alarm over President Trump's executive order that aimed to undermine the CDFI Fund, emphasizing its critical role in promoting equity and supporting minority-owned businesses. For instance, Minority Depository Institutions (MDIs) represent only 2% of U.S. banks but serve over 30% of Black-owned businesses, showcasing their importance in fostering economic growth in diverse communities.

Members of the committee stressed the need for vigilance against any attempts to dismantle the CDFI Fund, noting that every dollar invested in CDFIs can leverage eight dollars in private sector investments. This efficiency underscores the fund's value in driving economic development.

As discussions continue, lawmakers are committed to empowering CDFIs and MDIs, ensuring they can continue to provide essential services to communities across the nation. The committee's focus on these issues reflects a broader concern about the implications of regulatory changes on American prosperity and the financial well-being of consumers.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting