Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Lobbyists warn CMS waiver uncertainty could threaten Maryland hospital funding; assisted-living inspection bill falls short

County delegation and consultants brief committee on land use, ADUs, appeals and Chesapeake critical-area changes

Committee hears laws on planning, producer responsibility, energy credits and data center oversight

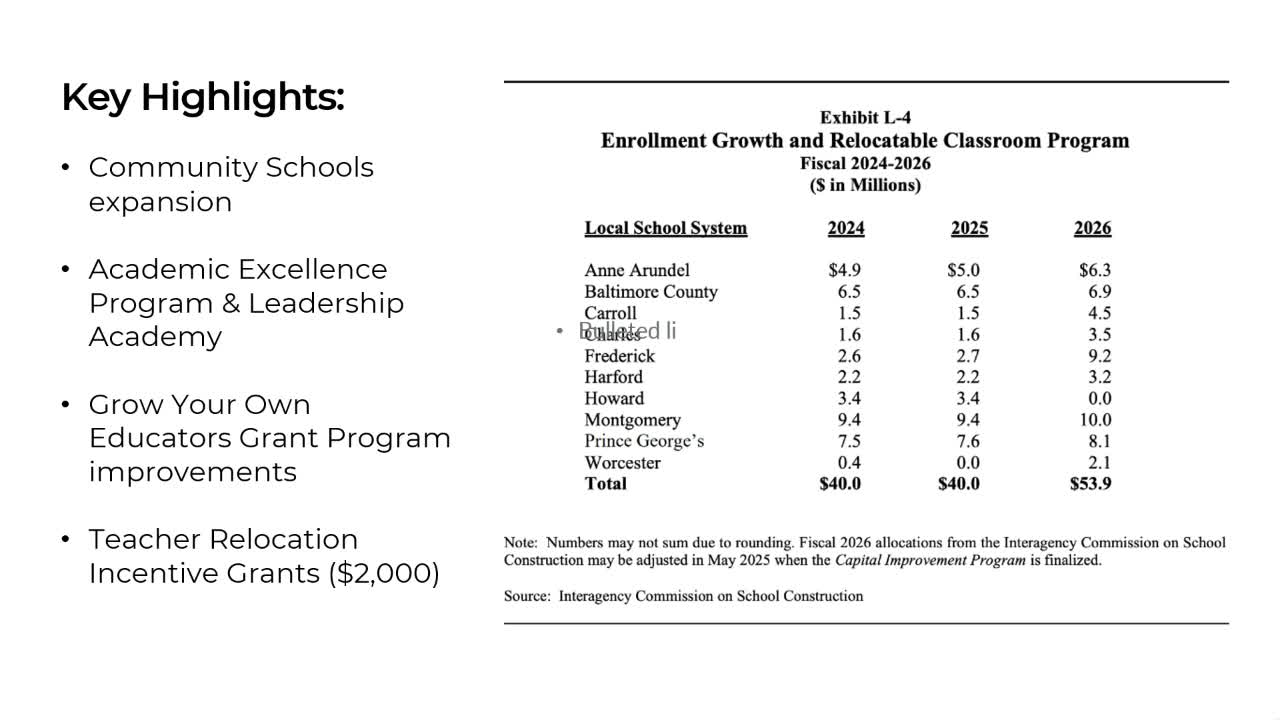

Committee briefed on education changes: collaborative time delayed, local shares shift under Maryland blueprint