Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

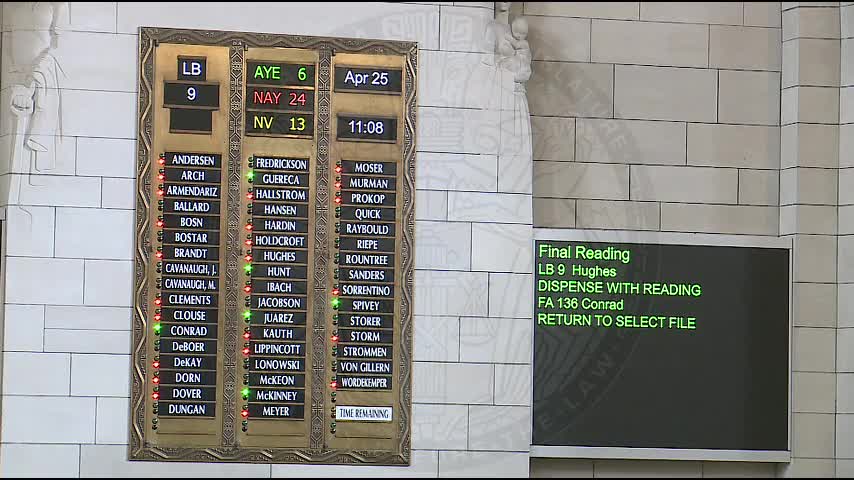

Votes at a glance: bills passed or advanced on final reading during April 24 session

Senate advances bill giving cities option not to assess property owners for improvement districts

Legislature amends public notice rules for unclaimed property and restricts commercial access to records

Senators advance bill allowing inmates confirmatory lab testing after field test drug positives

Legislature advances bill to regulate bare‑knuckle and other emerging combat sports

Senators advance second‑chance commutation bill after lengthy debate over victims and reentry