Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Board directs staff to draft school‑zone automated speed‑enforcement ordinance; public hearing set for June 10

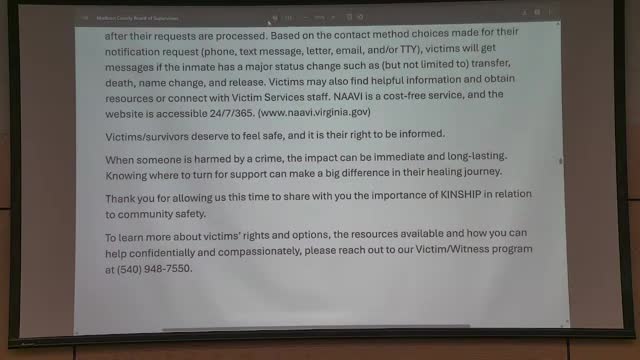

Commonwealth’s Attorney briefs Madison County on victim‑notification tools and caseload trends

Votes at a glance: Madison County Board actions April 22, 2025

Madison County board approves ordinance to fix 2025 tax rates after public hearing