Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Informational briefing: counties urge changes to assessment funding; bill would raise recording fee, restore delinquent interest to districts

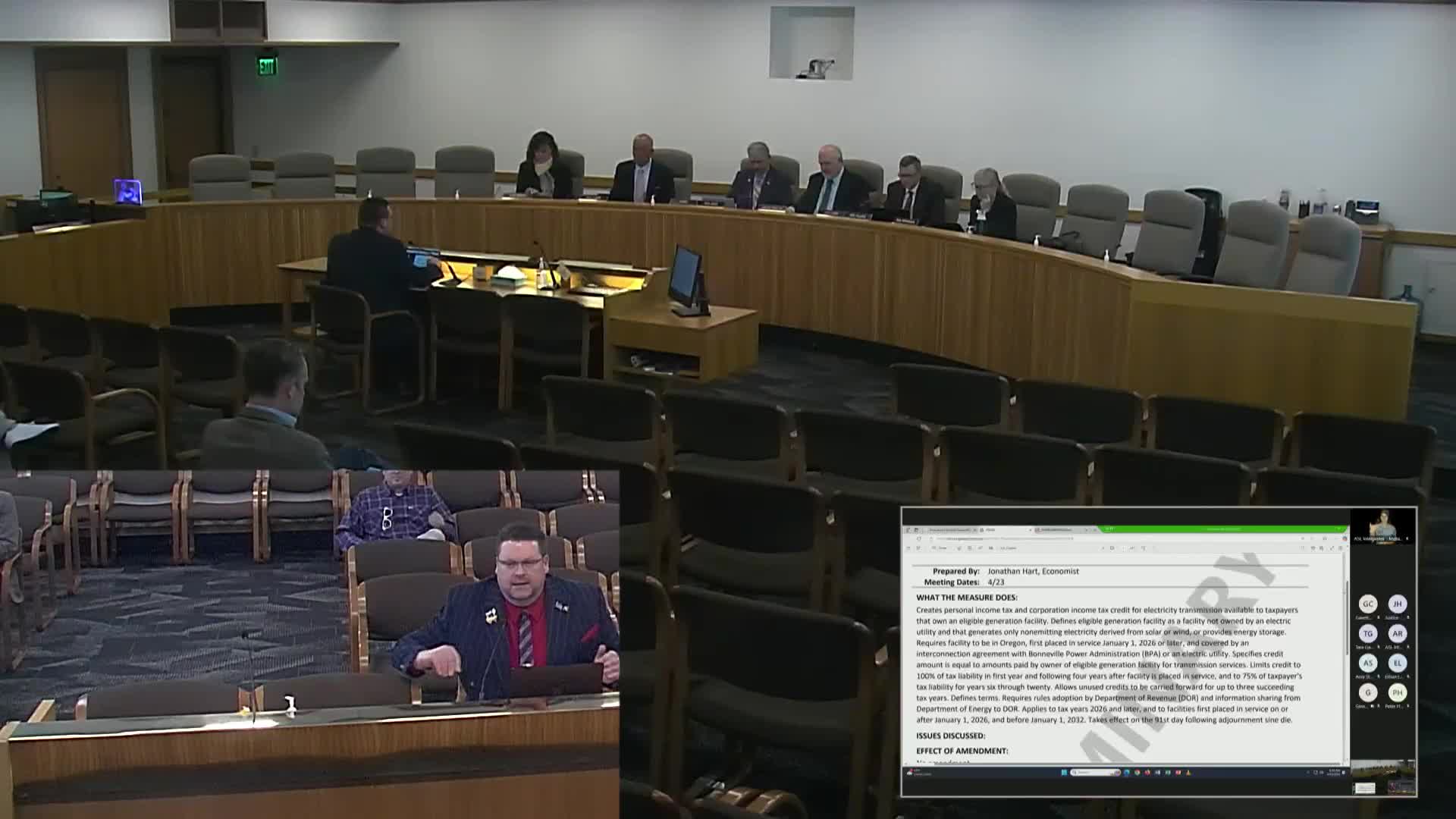

Senate committee hears public testimony on bill to credit transmission costs for in‑state solar, wind and storage projects