Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

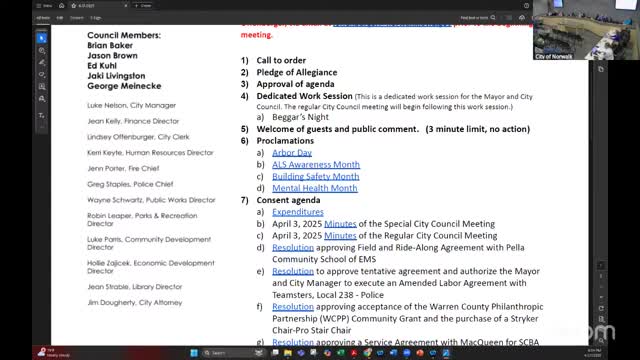

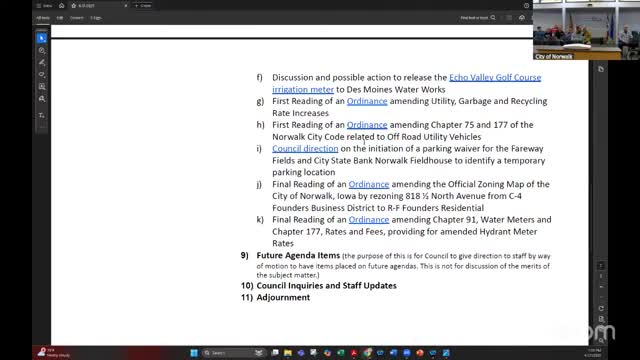

Resident urges Highway 28 wall at Sunset Drive; council directs staff to review

Council approves first reading of UTV ordinance; staff to align local code with Iowa law

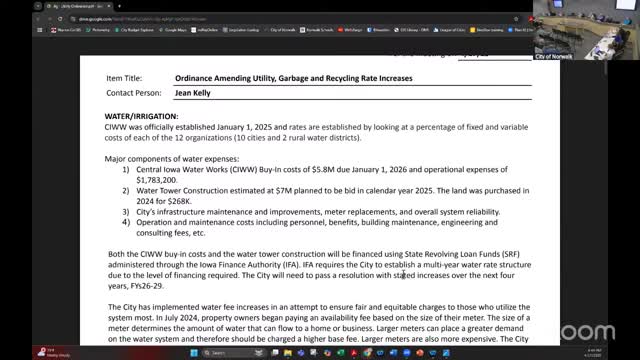

Council gives first reading to multiyear utility and garbage rate increases; water to rise up to 6% over four years

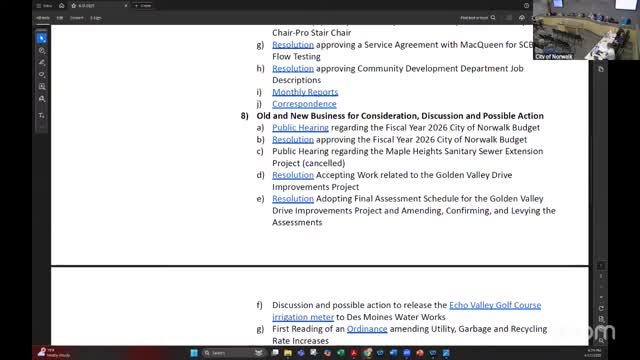

Norwalk council approves Golden Valley assessments, Echo Valley irrigation release and other measures