Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

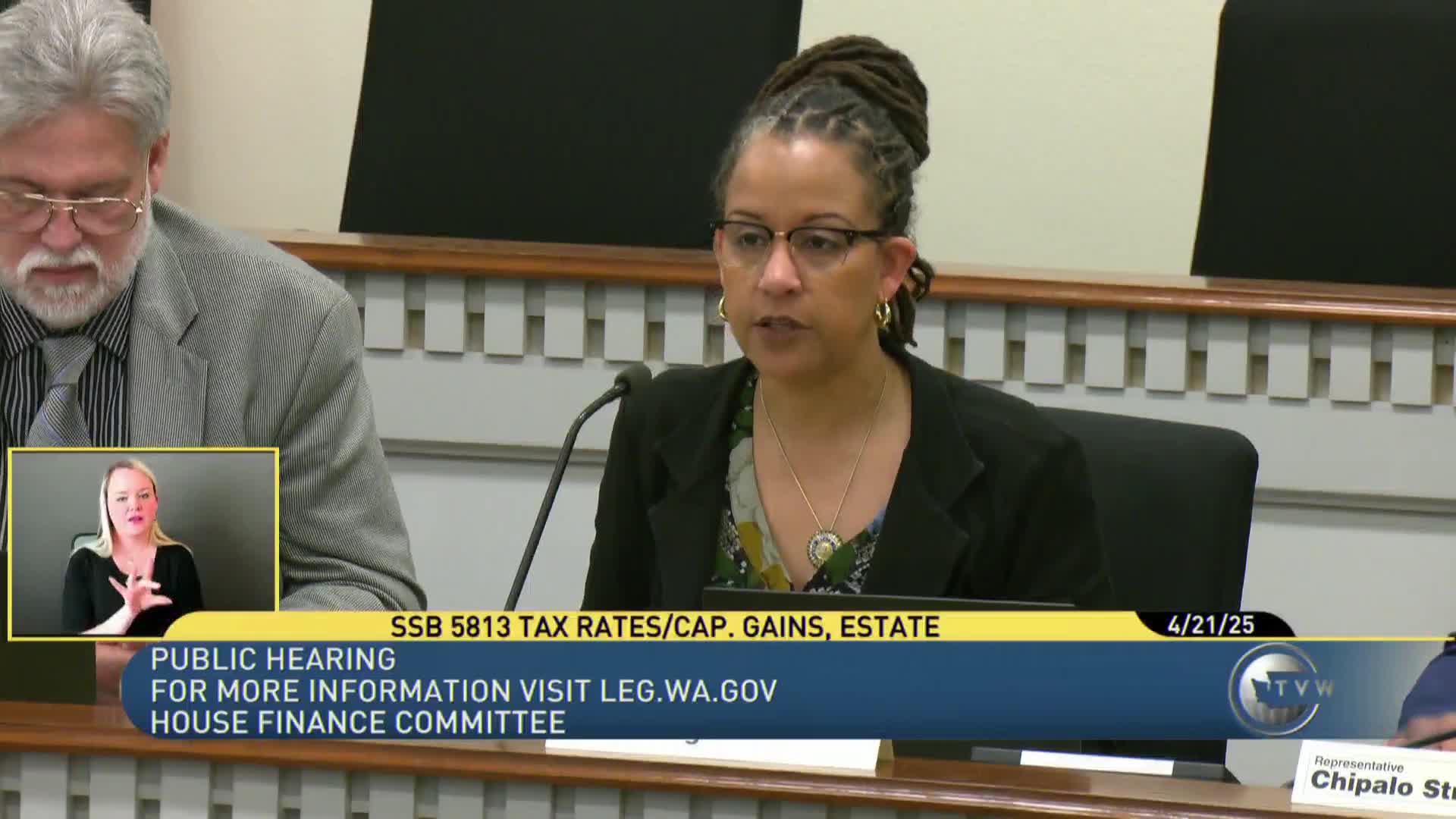

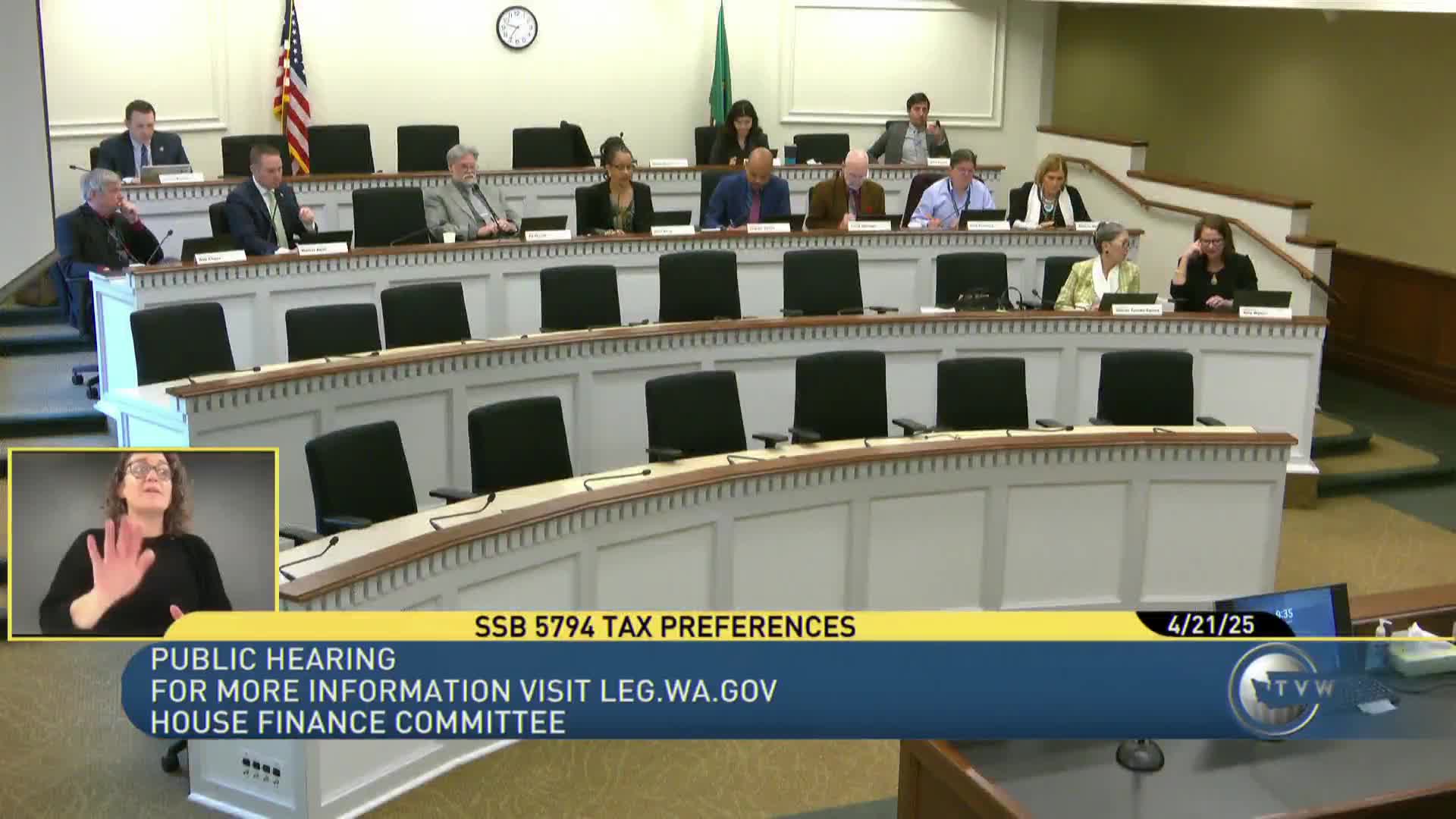

Committee hears hours of testimony on proposed expansion of sales tax to services, digital advertising and additional cigarette tax

Hearing on bill to repeal or sunset multiple tax preferences draws varied industry opposition and labor support