Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

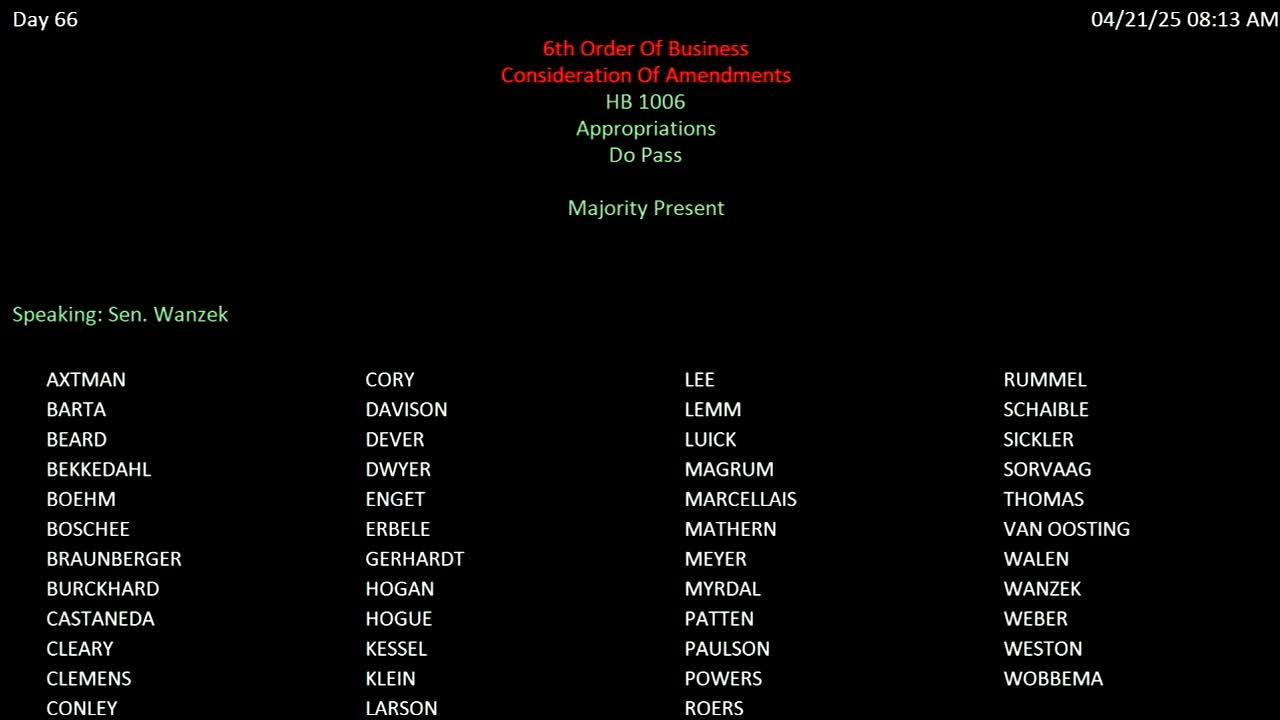

Votes at a glance: Senate approves a package of bills on coal tax, plates, water boards, human trafficking education and more

Senate funds tax commissioner's budget, adds salary adjustments and one-time tax-relief admin funding