Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Public Works pushes for asset management plan, flags rising materials costs and expands speed-camera program

County clerk outlines elections operations, new bureau facility and repurposing of mobile voting unit

Sheriff warns court-security vacancies and Metro Air funding gap; launches enforcement on Route 66

Bernalillo County rolls out Behavioral Health Authority structure and care-campus expansions; ordinance implementation begins

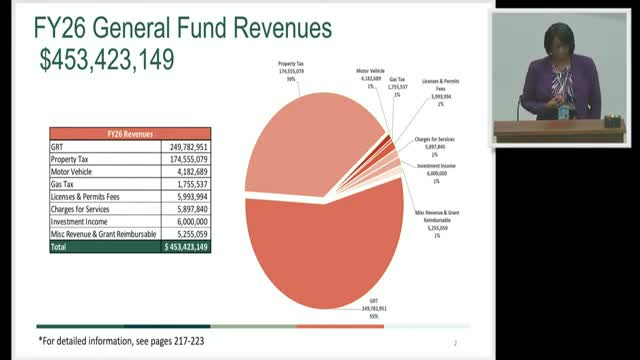

Bernalillo County managers present FY26 budget shortfall; balanced plan due to state by June 1

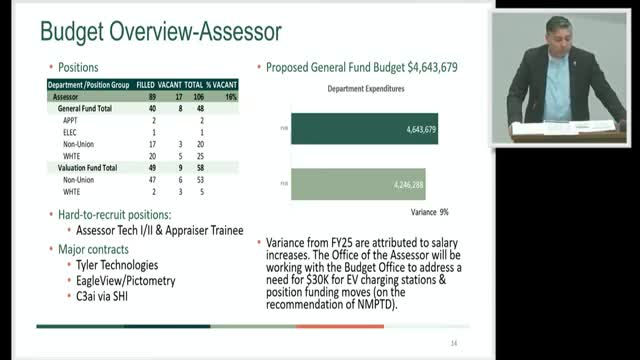

Assessor outlines revaluation plan to reduce disparity between residential and nonresidential assessments; multifamily treatment clarified

MDC population rise and staffing gaps prompt calls for modernization and new facility planning