Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

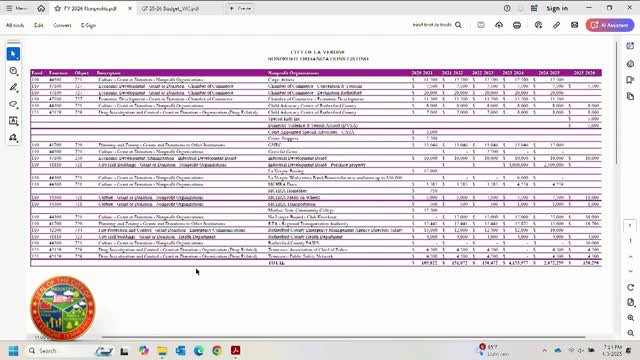

Board reviews nonprofit requests, senior-center contract and animal-control funding during budget workshop

Staff proposes Motorola radio replacement, vehicle and fire apparatus orders; long lead times noted for pumpers and ladders

Board considers City Hall remodel and temporary police space at new Public Works building; $40M police plan may be delayed