Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

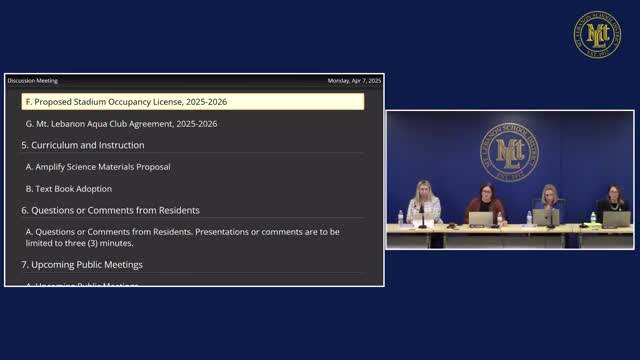

Mount Lebanon SD to display proposed K-5 Amplify science materials; textbook list posted for public review

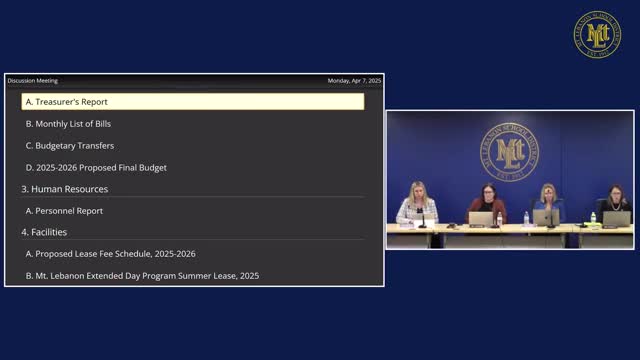

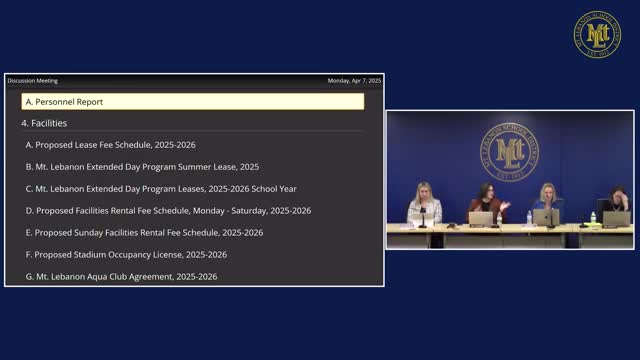

Mount Lebanon SD proposes 4% increase to facility and lease fees; extended day leases submitted for board approval