Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

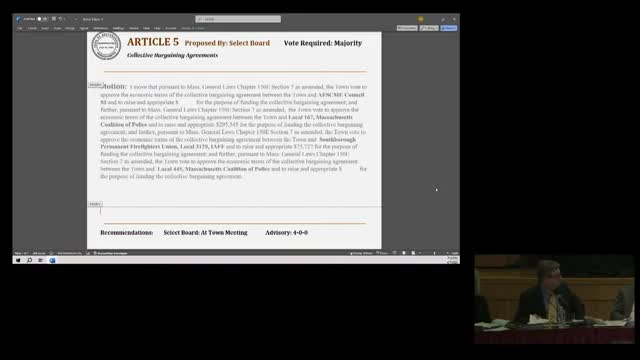

Town Meeting approves budgets, contracts and capital items; multiple zoning and project articles fail or are postponed

Southborough Library returns $150,000 set aside for planning after state construction grant denial; staff report on programs