Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Developers press for higher 9% LIHTC cap as rising construction costs shrink projects; preservation advocates warn of lost projects

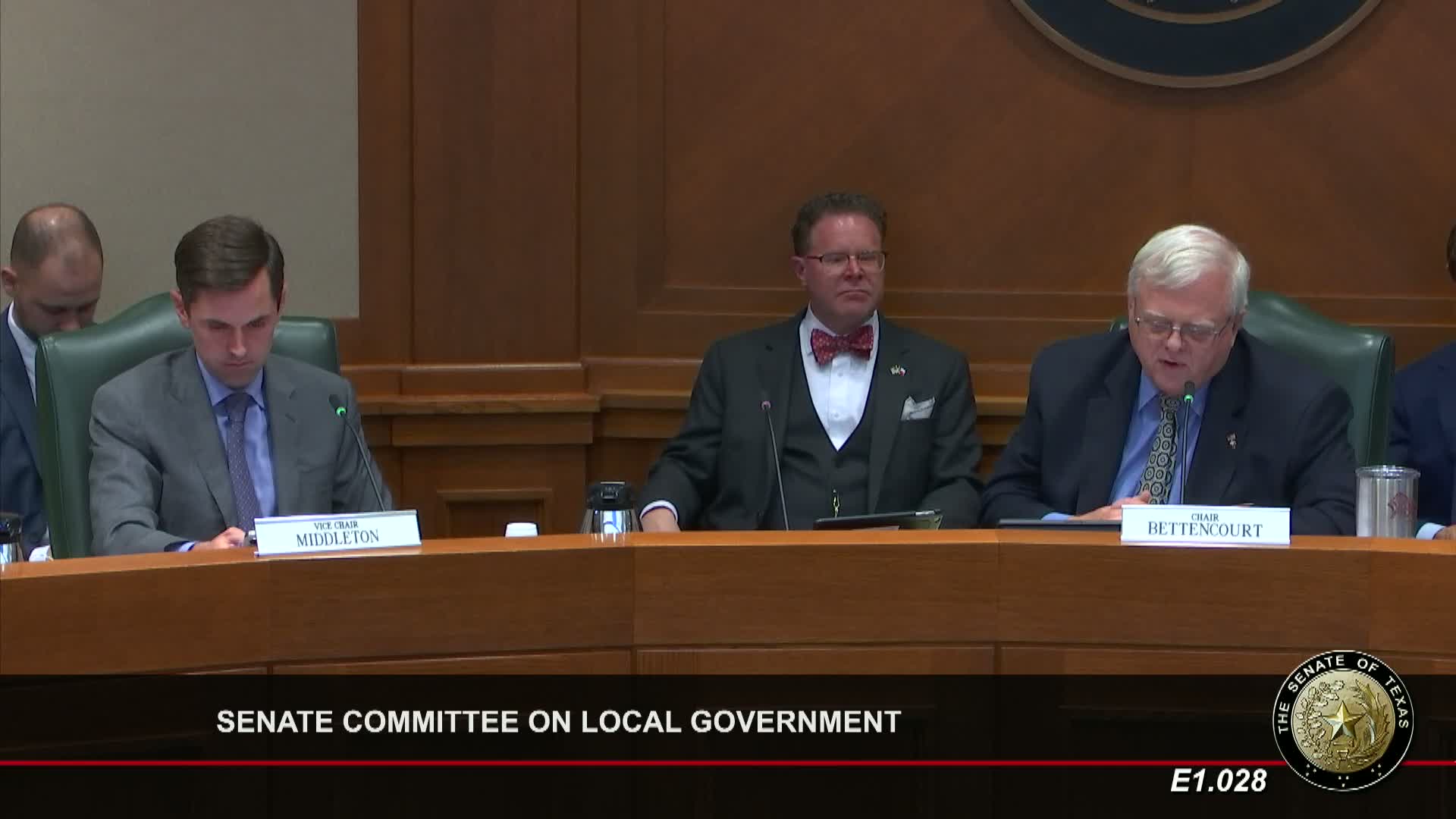

Senate panel hears competing views on HOA reforms aimed at resident control and limits on fines, assessments

Senate committee debates ban on local guaranteed‑income programs as residents and advocates testify

Senate committee hears calls to raise penalties for public contracting abuses after Harris County cases