Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

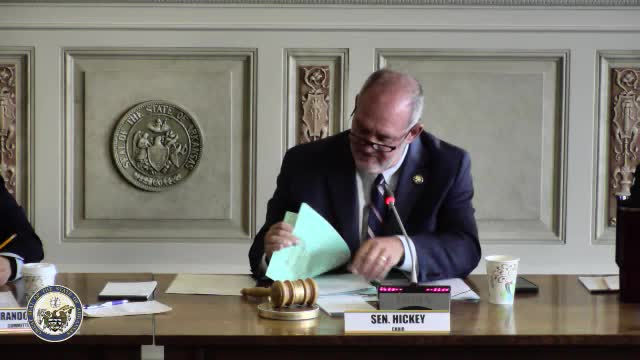

Committee clarifies appeals path for homestead freeze disputes; bill passes

Municipal League-backed bill to streamline abatement and foreclosure of dilapidated property draws legal questions in committee

Committee passes bill to extend property-tax exemption to leased vehicles used exclusively for charity

Committee adopts amendment removing state buyback from tax-credit package for renewable fuel project; bill then passed as amended

Committee lowers electronic filing threshold for employer withholding reports to 75 employees

Committee approves change allowing DFA to set mileage rate by proclamation