Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

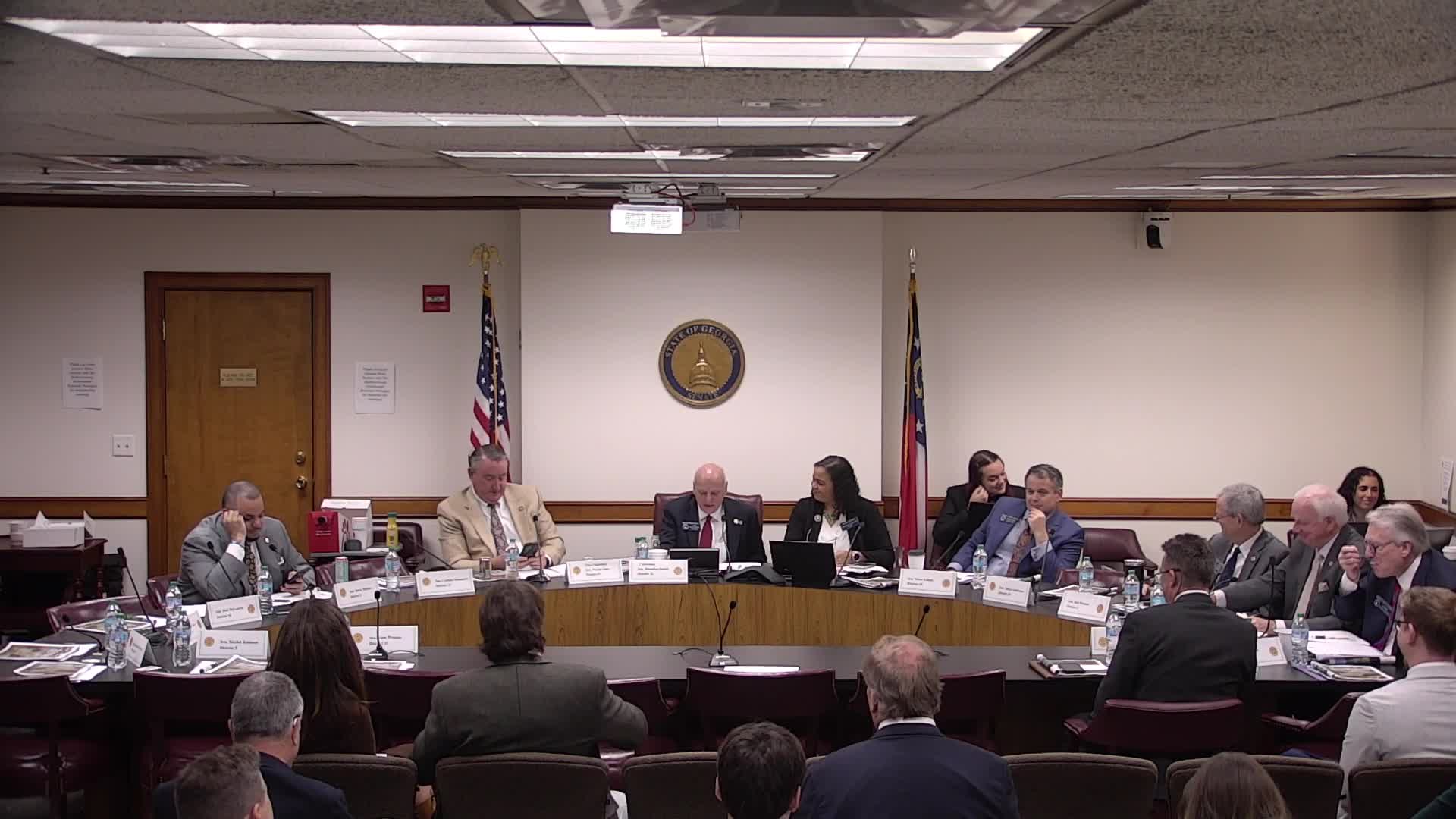

Committee advances amended HB 14 after removing post‑production tax credit; music office and procurement language retained

Advocates press state committee for clearer river-access rules, citing lost public passage and business impacts