Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

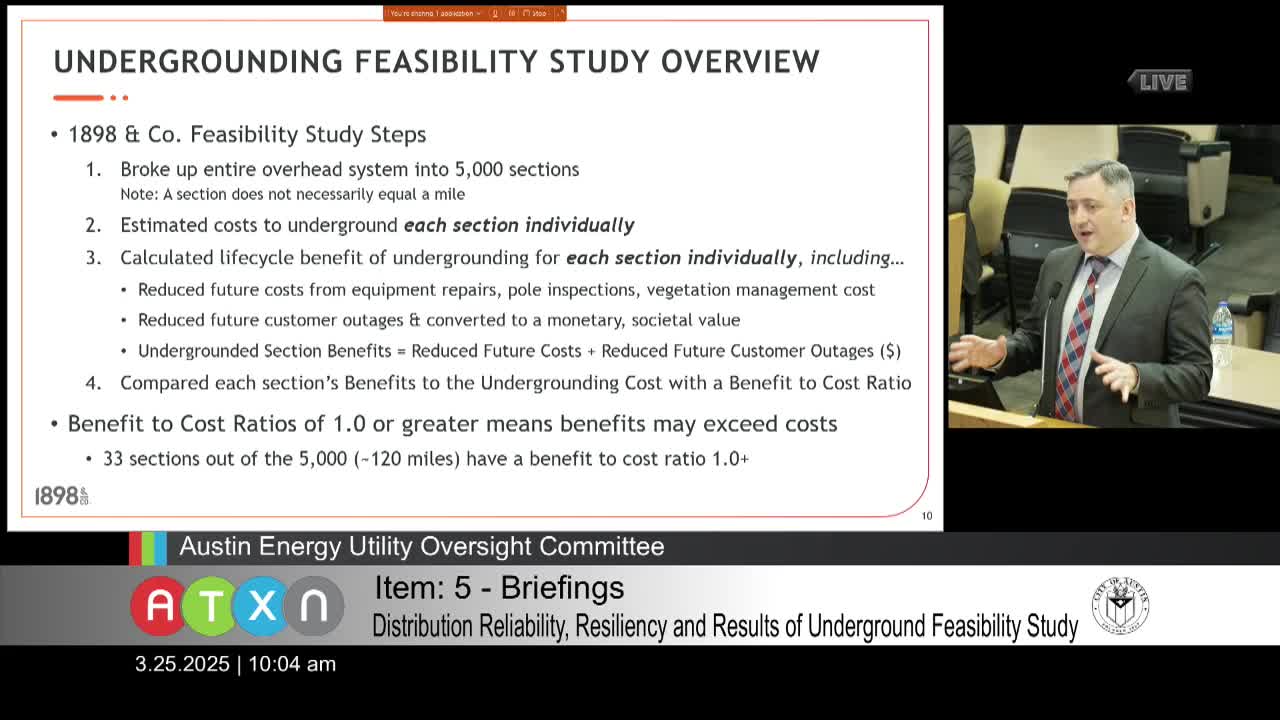

Austin Energy study: systemwide burial of distribution lines would cost about $50 billion; recommends targeted undergrounding

Austin Energy reports 43% renewable generation in Q1, 63% rolling 12‑month carbon‑free share; staff warns trend is downward

Austin Energy reports favorable first‑quarter operating income, $241 million bond sale; S&P affirms AA‑ rating