Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

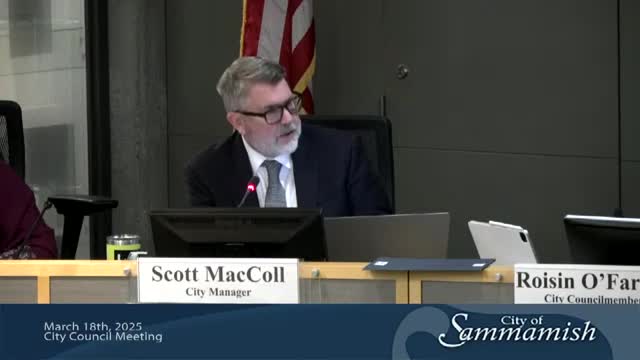

Former communications staffer asks Sammamish council for public apology after court ruled suspension unjustified

Council approves short-term lease extension for Central Washington University facility through June