Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

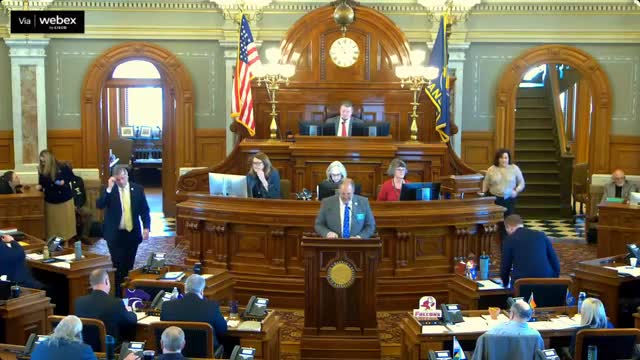

Votes at a glance: House approves several insurance, regulatory and administrative bills

House approves bill increasing township bonding limits, including higher limits for fire departments

Kansas House adopts constitutional amendment to cap valuation swings with multi-year average